A Guide to Secondaries: the gateway to unicorns

When it comes to investment choices, many people no doubt wish they could have invested in unicorns like Bytedance, SpaceX, Stripe and Epic Games. But the opportunity to participate in the funding rounds of such prominent companies are usually quite limited. Only a select few of the top venture capital and private equity firms are given the chance, meaning investor categories like high net-worth individuals, family offices, and regional funds often get left out.

But that doesn’t mean you have absolutely no chance to invest in these private companies; that unmet demand is partly why the secondary market exists, and it has only been increasing in size. In this guide, we dive into the secondary private equity opportunity—from how and why the market has been growing, the benefits of owning secondaries, and how we can help you source such deals.

Definitions 101: Primary vs Secondary Transactions

The primary market is driven by startups who are looking to raise funds, and these companies issue new shares to investors in exchange for their monetary investment. The secondary market comes about when these investors are looking for an exit on their investment.

This is conceptually similar to the public markets. Most transactions in the stock market are secondary - when one investor sells their shares to another. In both public and private markets, the buyer will take on the existing rights of the seller’s shares.

However, there are a few important differences between them which you should be aware of. Secondary transactions on the public markets have:

- Fast transaction times: Purchasing publicly listed shares can be nearly instantaneous

- Higher liquidity: High transaction volumes mean it is usually very easy to buy or sell public assets

- Greater information symmetry: Buyers and sellers largely have access to equal levels of information; this is also often enforced through regulation

Secondary transactions on private markets, by contrast, have:

- Slower transaction times: The process of price negotiation, due diligence, and rights transfer takes a much longer time

- Low liquidity: In the absence of platforms like Alta which make discovery of investment opportunities easier, it can be very difficult for primary investors to find potential buyers for their private equity shares

- Information Asymmetry: Primary investors usually have access to the company’s founders and other proprietary business information—secondary investors typically do not. This can create information asymmetry between buyers and sellers, which could also cause some hesitation from secondary investors if they feel they don’t have all the information they need.

The Growing Secondary Private Equity Market

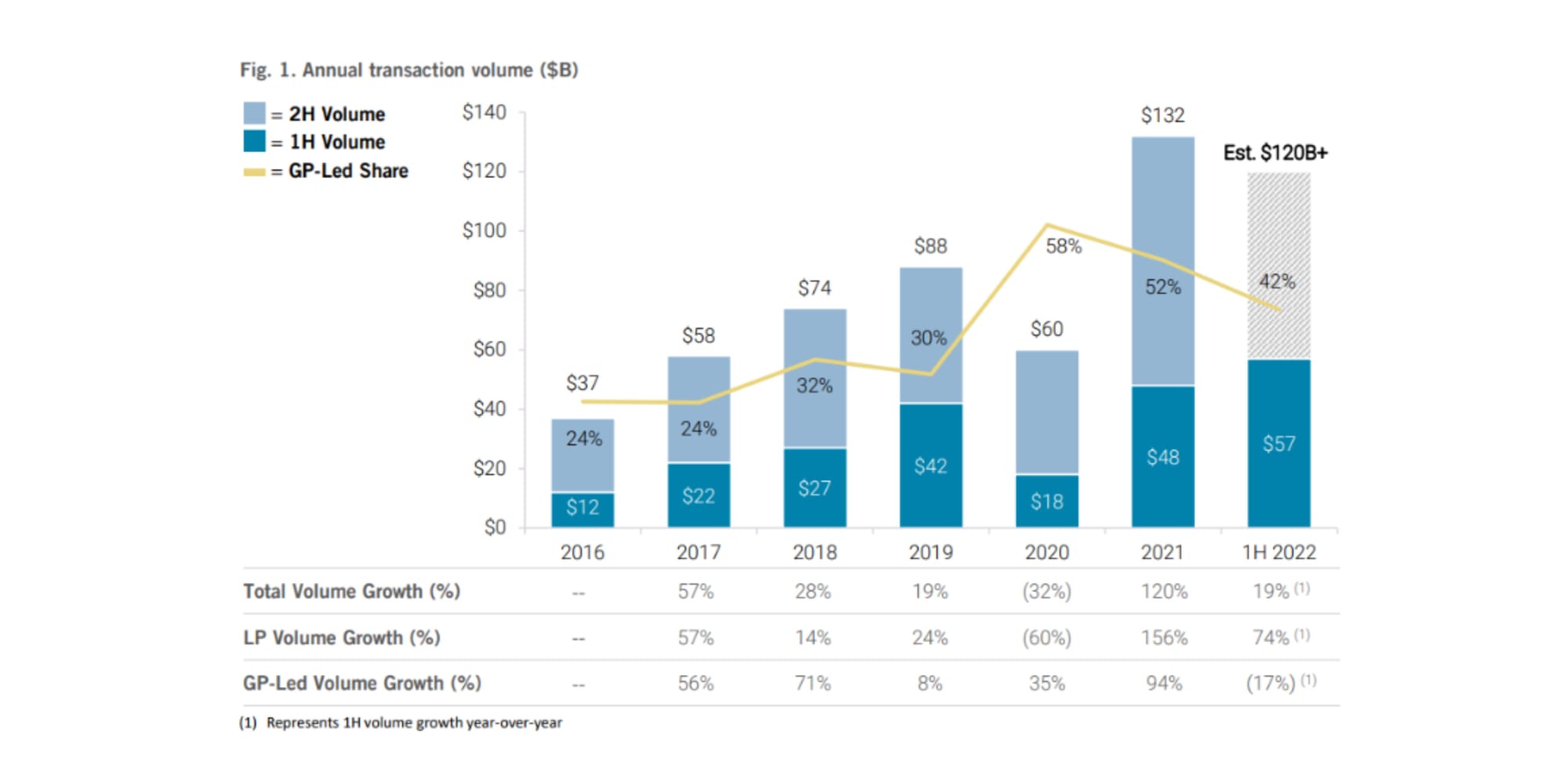

The private capital secondary market has experienced rapid growth over the past decade. Since 2012, the secondary market has grown to more than five times its previous size, reaching a record $132bn in 2021.

According to the Jefferies report, most of this volume comes from the funds’ Limited Partners (LPs)—the investors who commit capital to the funds. However, the share of deals led by the funds themselves (called General Partners, or GPs) are rising. Global secondary volume in 1 H 2022 was $57 billion, surpassing the prior 1H record of $48 billion in 2021. Strong buy-side demand, combined with thoughtful portfolio construction and seller transaction flexibility, led to this record level of secondary volume.

Many LPs, who are increasingly overweight private exposure, brought transactions to market to rebalance their asset allocations. LP volume was $33 billion and accounted for 58% of market volume. Meanwhile, GP-led transactions accounted for 42% of first-half volume, reaching $24 billion.

All these statistics show that interest in the secondary private equity market from both investors and private equity funds are increasing. But what are the main factors driving such volumes?

Key Factors Driving Interest

According to a report by Industry Ventures, the global secondary market is expected to grow to over $130 billion in 2023. The key factors that will drive this growth include growing allocations to venture capital, extended time horizons for startup exits, increased investor demand for liquidity and the proliferation of new secondary deal structures, resulting in a large and expanding venture secondary market.

Growing allocations to venture capital

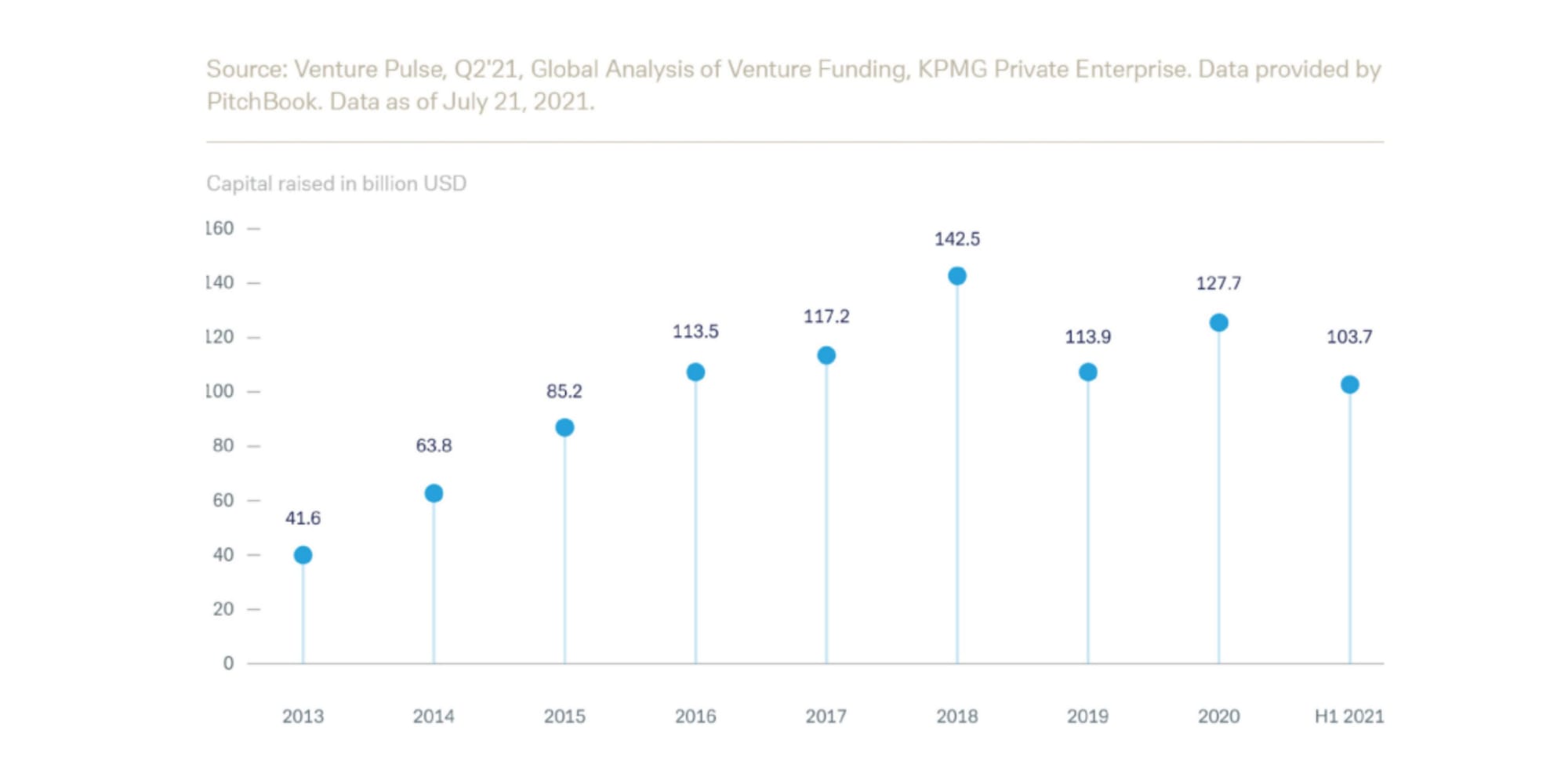

Global Venture Capital investment increased at a 13.5% compound annual growth rate (CAGR) between 2015 and 2020, to reach a total of USD330.20 billion in that year.

Investors have also continued to commit large amounts of funds to Venture Capital funds. USD 127.70 billion was raised in 2020, with capital commitments then reaching USD103.70 billion in H1 2021.

Adoption of advanced technologies and changing investment habits may also enable the Venture Capital market to grow even further. Mutual funds and new generation banks, neobanks and fintechs are also making it easier for their clients to access the Venture Capital universe.

IMARC, a leading market research company, estimates global Venture Capital investment to grow at a CAGR of around 16% over 2021-2026. If the market hits this number, it would represent an even faster growth than over the last five years.

Companies are Staying Private Longer

Companies, particularly technology companies, are staying private much longer than before. According to Nasdaq, in 1980, the median age of a company at its IPO was 6 years, and the the median market value of a company at its IPO (adjusted for inflation) was $105 million. Whereas in 2021, the median age was 11 and the median market value was $1.33 billion. From 1980 to 2000, there were more than 6,500 IPOs while years 2001 to 2022 saw fewer than 3,000.

- Lower ongoing costs: Fewer regulatory and reporting requirements and their associated costs—a PwC CFO survey showed an annual cost of USD1 – 1.9 million for staying public

- Going public is expensive: The same survey found that, on average, underwriting fees take 4% – 7% of gross proceeds plus USD4.2 million of offering costs. This also does not include legal and accounting fees

- Preference for secondary sales or mergers and acquisitions (M&As) for exits: Founders may look at secondary market sales or M&As as ‘cleaner’ exit opportunities—according to PwC’s MoneyTree report, M&A exits happen nearly a year earlier than IPOs. Further, there is also no risk of an underperforming IPO which will likely be highly publicised

- Strategic investor selection: By staying private, founders can choose investors that can add strategic value beyond just capital e.g. industry connections, name recognition, or contracts. Founders can also retain more control

- Normalisation: The trend of companies staying private for longer has become the new normal—both investors, founders, and employees have become accustomed to this arrangement

The Need for Liquidity

The supply of shares in the secondary market comes from 2 main sources: Institutional Investors and Employees. As we mentioned previously, the secondary market largely comes from investors looking for an exit on their investment. However, it can also come from employees who would like to liquidate their shares that they own as part of their Employee Share Options Plan (ESOP).

1. Institutional investors: PwC’s MoneyTree report puts the average time to M&A or IPO at 6.6 and 7.5 years, respectively, meaning primary investors look towards the secondary market for an exit on their investment

2. Employees: Startups often use ESOP as a means to hire and retain staff. As the company grows, employees find themselves sitting on significant wealth through vested shares. The secondary market is an avenue for them to monetise their shares.

This need for liquidity is thus the primary supply generator of secondary private equity deals. And that liquidity premium manifests in the discount a seller typically has to offer on the secondary market. According to a study of sale prices of secondary transactions involving private equity funds, the average discount over Net Asset Value (NAV) was 13.8%. However, this study used data from 2006 to 2014. More recent data found the median discount value had essentially disappeared, while the mean now stands at 2%. This indicates demand for secondary deals might be rising faster than supply.

On top of liquidity, there are several other interrelated factors creating supply for secondary private equity deals.

- Portfolio rebalancing: Due to rising valuations, funds may end up becoming too heavily weighted in private equity, and may need to sell to maintain their desired asset allocation ratios

- Private equity capital generation: Towards the tail-end of a fund’s lifecycle, a GP may monetise their stake in their portfolio companies in order to generate cash distributions to their LPs. This allows them to create a good track record which will be important for subsequent rounds of fundraising.

- Desire for diversification: Investors in primary equity deals may wish to reduce their risk exposure to private equity. For employees, they may find themselves suddenly “wealthy” on paper due to an increase in the value of their employee shares based on the success of the company. However, a large part of their wealth is dependent on the performance of the company and they might wish to diversify some of that risk

Appetite for Private Equity Opportunities and Specific Advantages

The global appetite for private equity opportunities is largely fueled by:

- The trend of private companies staying private for longer

- The search for yield in the low interest-rate environment that was precipitated by the global financial crisis

- Record amounts of cash (called ‘dry powder’) or capital waiting to be invested in private equity deals—USD1.96 trillion as of 15 December 2022.

But while overall appetite for private equity may be the major demand driver, there are advantages secondary deals confer that also add to this demand:

- Potential discounts: Although recent evidence points toward a smaller discount, in general, secondary buyers often obtain discounts over latest valuations—typically between 5% and 15%

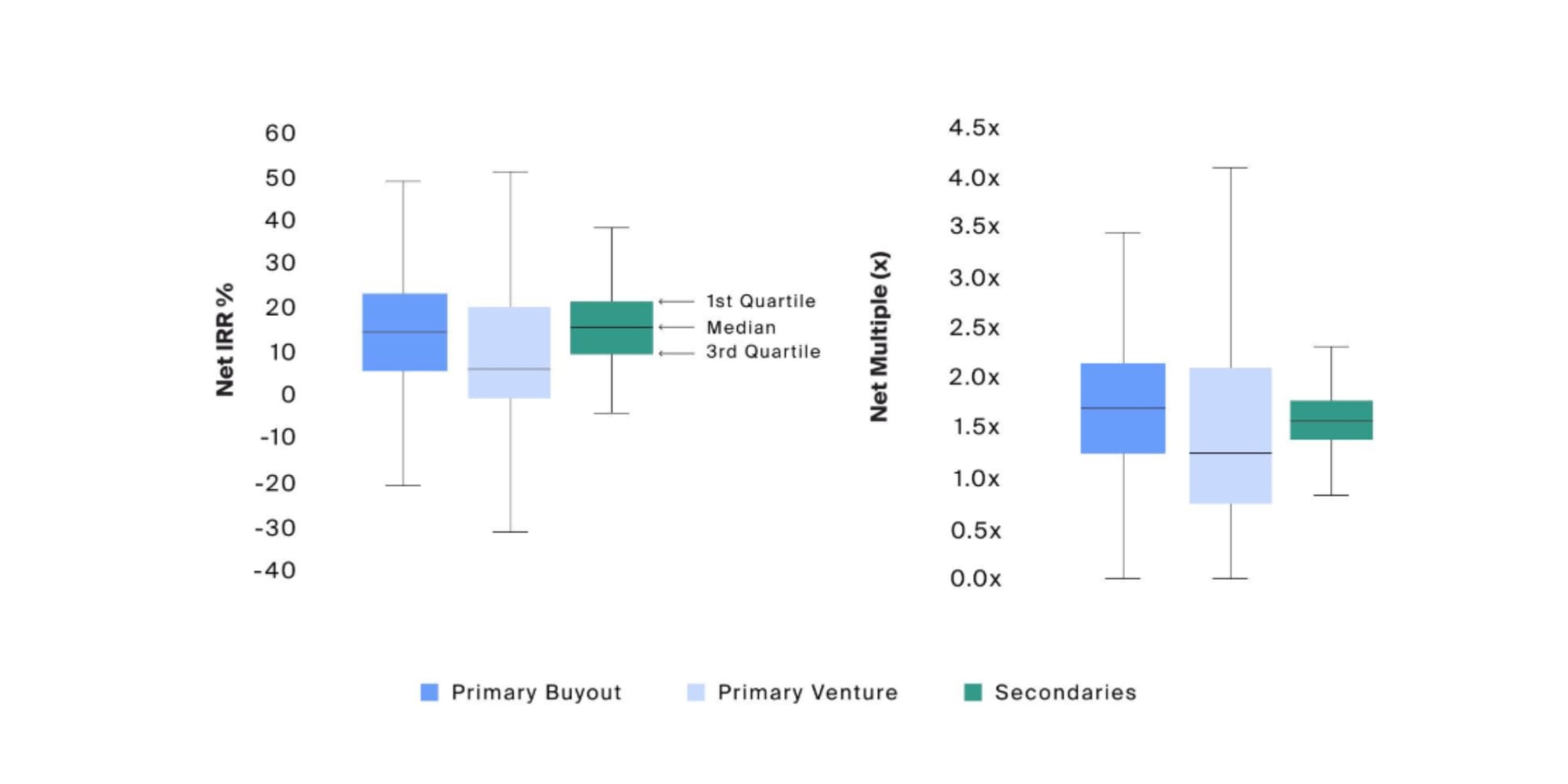

- Improved returns: Secondaries collectively appear to produce a higher median IRR and lower dispersion of returns when compared to primary private equity subclasses. Dispersion across secondaries funds is relatively lower than primary buyout and venture, which may result in more consistent (but lower) returns

- Shorter time to exits: Secondary investors have a shorter time horizon until a typical exit

- Removal of early stage risk: A startup’s risk is highest in its early stages. In the standard exponential growth ‘J-curve’, the risk is greatest at the bottom. The secondary investment pool is of a generally better quality as we only see the survivors—companies who have already made it past the bottom of the curve

- Lower transaction minimums: Since the secondary market is much more open than the primary one, transaction minimums are typically more ‘bite-sized’. This gives buyers an affordable way to build diversified exposure to a basket of the best private equity opportunities

- More time for due diligence: Without the rush to close funding rounds, solvent buyers have more time for due diligence than is typical in primary markets

The Two Types of Secondary Private Equity Transactions

There are two types of secondary private equity transactions: direct investor purchases and fund interest purchases.

A direct investor purchase is when the secondary investor purchases the equity is purchased directly from a primary investor. For example, an angel investor sells their stake to another high net-worth individual. Once the transaction is completed, the new owner of the shares will be included on the company’s cap table. This is the primary option we offer our investors at Alta.

A fund interest purchase is a method in which a buyer takes over a limited partnership interest in a private equity fund from an existing LP. Primary investors, who committed their interest at the inception of the fund, must mostly rely on the track record or reputation of the fund manager or GP. Secondary investors, however, have the chance to analyse the actual assets the fund has purchased.

Additional Due Diligence Considerations

Secondary investors should, in their own interest, go through as much of the due diligence process as possible (read our guide here). Although early stage risk may have been reduced, secondary investors should keep in mind potential informational gaps and do their best to glean as much information from the primary investor as possible prior to committing.

Sourcing Secondary Private Equity Deals

In the absence of direct contacts with other primary investors, another way to source quality secondary private equity deals is through platforms such as Alta. As the largest private investments platform in Southeast Asia, Alta is well positioned to assist buyers and sellers with the placement, discovery, trading and settlement of privately held shares, making it a simple one-stop portal to settle your private investment needs. Interested buyers can leverage Alta’s extensive array of secondary deal opportunities, sourced from venture capital and private equity funds, family offices, well-connected industry participants, and startup employees.

With a network of over 13,000 institutional and accredited investor accounts, we can accommodate secondary sales from a spectrum of sectors, sizes and geographies. We welcome sellers to tap on our vast network to connect directly with professionals and institutions who have the experience and knowhow to understand and invest into your business.

To find out more about how Alta can serve both buyers and sellers of secondary investment opportunities, contact us today.