[Updated April 2024] Artificial Intelligence: Tech Fad or Fixture?

![[Updated April 2024] Artificial Intelligence: Tech Fad or Fixture?](/content/images/size/w2000/2024/04/image--9-.png)

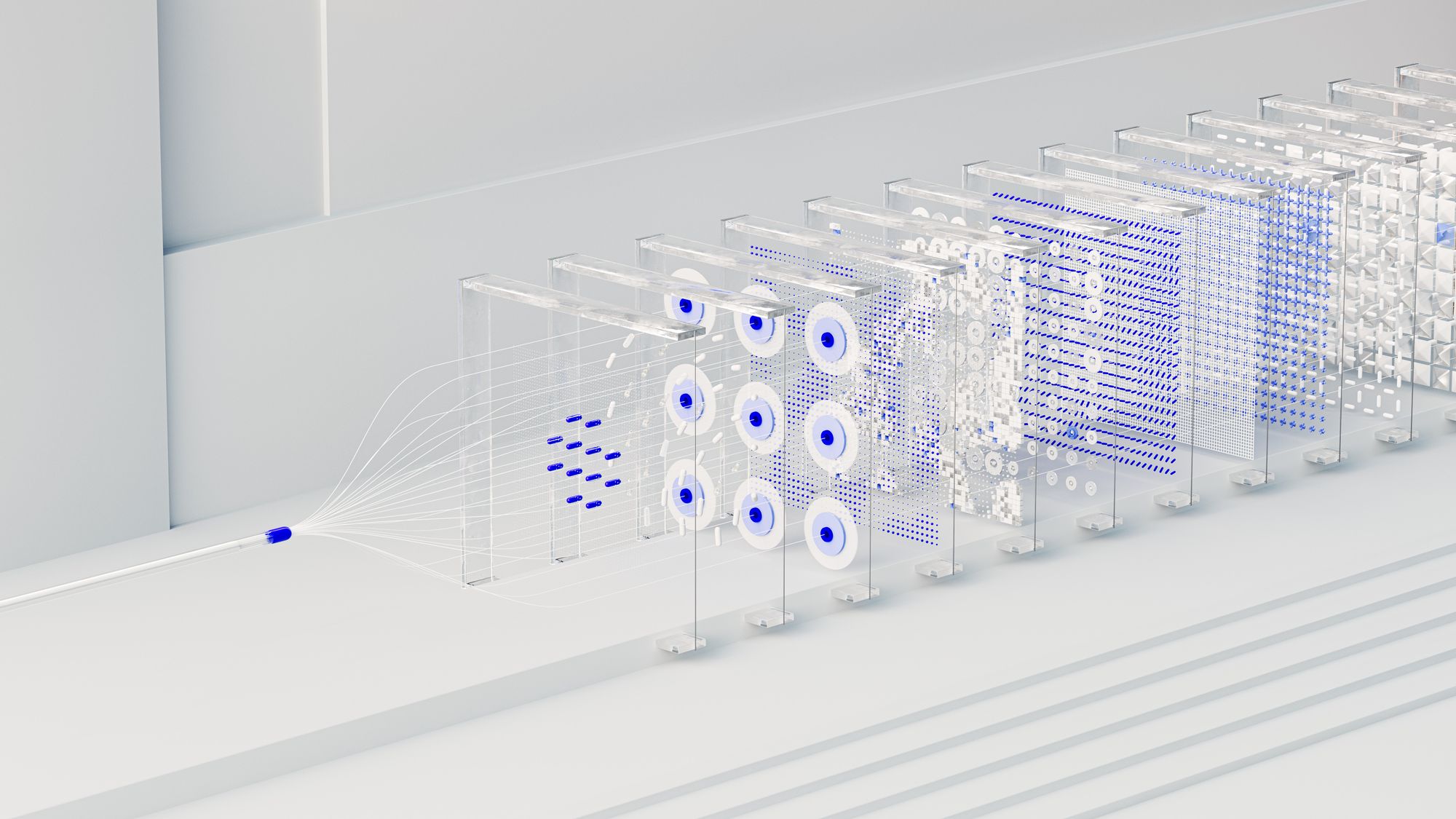

Artificial Intelligence (AI). It powers our devices, and influences our decisions; and recently, it’s even doing our work for us. It’s invoking wonderment, amazement, skepticism, fear, all at once. Whether those emotions are warranted is up for debate, but what’s undeniable is that AI is rapidly transforming our world.

The impact is palpable; today, AI is being rapidly deployed across a wide range of industries, from healthcare to finance and from transportation to education, delivering an estimated increase of value of as much as 40%. Even evolution isn’t spared.

In the whirlwind of 2024’s tech scene, xAI stepped onto the stage with a bang, unveiling the preview of Grok-1.5V, a cutting-edge multimodal marvel. From parsing text with finesse to effortlessly digesting a smorgasbord of visual content—think documents, diagrams, charts, even snapshots—Grok does it all, and it does it brilliantly.

Meta, the titan of social media, is shaking things up with the grand debut of Meta AI, a savvy artificial intelligence sidekick taking its platforms by storm, with your favorite social hubs—WhatsApp, Instagram, Facebook, Messenger—infused with a touch of AI magic, ready to enhance your experience like never before. It's Meta's boldest foray into the world of AI yet.

Apple too is cooking up some AI magic of its own. Rumor has it that the tech giant is deep in talks to integrate Google's Gemini AI engine into the very heart of the iPhone. With whispers of new features on the horizon, the anticipation for Apple's AI-infused future is positively electric.

As AI industry continues to grow at an unprecedented pace, what are the opportunities for investors looking to participate in its astronomic rise? In this post, we look at the up and coming technologies in the field of artificial intelligence, and take a peek at the disruptive power that could dramatically improve – or redefine – our world.

OpenAI, the company behind ChatGPT

OpenAI is an AI system that was initially conceived as an open-sourced framework for developing AI capabilities, but as of GPT-3, OpenAI is no longer “open”. Set up with the primary goal of creating a more positive future for humanity by developing and promoting AI technology that serves people equitably, OpenAI has become the focal point for re-evaluating the role of AI in our lives.

In November 2022, OpenAI released ChatGPT. The chatbot, essentially a fine-tuned version of its earlier text-generators delivered over a chat interface, impressed the public with its humanlike prose and canny replies. ChatGPT is estimated to have reached roughly 100 million active users in January, reports show, making it one of the fastest adopted technologies in human history.

What makes OpenAI "open", then? Fundamentally, OpenAI presents a collaborative initiative that aims to democratize AI research and development by creating a pool of resources, tools, and expertise that can be shared by anyone. OpenAI's mission is to ensure that AI technology benefits all of humanity, not just a select few.

While far from perfect, the incredible proliferation of tools and applications stemming from ChatGPT’s prompt interface given observers cause for concern over the security of knowledge workers.

The intense interest in ChatGPT has sparked similar products. Microsoft’s chatbot, which refers to itself as “Sydney,” was unveiled in February this year at an invite-only event in Redmond, Wash. Just days before, Google showcased its chatbot, called “Bard.”

AI revolutionizing Fintech

Financial services ranks as one of the sectors that continues to develop despite worldwide economic disruptions from the pandemic and quantitative tightening. As the financial sector faces reduced margins and declining revenues, fintech solutions driven by the promise of increased efficiencies through the adoption of multifunctional uses of AI promise a measure of relief.

As evidenced by Dr Paul Sin at Deloitte, the fintech industry has kept up closely with the latest AI breakthroughs. One of the first use cases was that of robo-advisory, where investors' funds are managed by AI instead of a fund manager. Today, AI is being implemented for front- and back-office processes, like “Know Your Customer” (KYC) processes and client success. Today, in 2023, the market for AI in fintech is estimated to be over US$42 billion and is set to reach close to US$50 billion in 2028.

Overall, AI has provided the financial industry with a means to meet the needs of clients who want smarter, more convenient, and safer methods to access, spend, save, and invest their money.

Zest AI helps financial service providers carry out better risk profiling and credit modeling. By leveraging machine learning, the company enables companies to increase approval rates, cut credit losses, and improve underwriting processes.

One of Zest AI's primary goals is to grant everyone fair and transparent credit access and build an equitable financial system. The company has developed the Zest Automated Machine Learning (ZAML) platform, an AI-powered underwriting system that assists businesses in assessing borrowers with little to no credit information or history.

Also, it uses machine learning to analyze hundreds of data points, including traditional and non-traditional data, to predict credit risk accurately.

Enova is a lending platform which provides advanced financial analytics and credit assessment. Enova created the Colossus platform, which uses artificial intelligence and machine learning to give advanced analytics and technology to consumers, enterprises, and banks to support responsible lending.

The Colossus assists customers in resolving real-world issues, such as emergency costs for consumers and bank loans for small enterprises, without putting either the lender or the beneficiary in an untenable scenario.

SESAMm specializes in big data and artificial intelligence for investment, providing organizations with the ability to make timely decisions by tracking ESG, risk controversies, and positive events. One of SESAMm's standout features is its off-the-shelf platform, TextReveal®, which empowers users to generate AI insights from web data on millions of companies in less than a minute.

In addition to providing sentiment analysis algorithms that rely on deep-learning techniques, SESAMm leverages advanced NER (named entity recognition) and disambiguation techniques to properly detect relevant companies in multiple languages.

HighRadius is a SaaS FinTech startup that uses AI-based autonomous systems to help automate Accounts Receivable and Treasury processes. The company offers cloud-based Autonomous Software for the Office of the CFO and has transformed the order to cash treasury and record-to-report processes.

HighRadius delivers measurable business outcomes such as DSO reduction, working capital optimization, bad-debt reduction, reduced month-close timelines, and improved productivity in under six months, utilizing AI to automate and optimize complex financial processes.

Cohere was founded to create a platform that empowers all enterprises to transform their company and products with world-leading AI that’s cloud-agnostic, accessible, customizable and data-secure. Their mission is to allow enterprises worldwide to leverage this transformational technology.

Cohere, which has developed multilingual language models trained on data from native speakers, among other AI, aims to stand out in the ocean of generative AI startups by focusing on enterprise use cases.

Cohere’s AI platform is cloud agnostic, able to be deployed inside public clouds (e.g., Google Cloud, Amazon Web Services), a customer’s existing cloud, virtual private clouds or on-site. The startup takes a hands-on approach, working with customers to create custom LLMs based on their proprietary data.

xAI's mission is to create AI tools that empower people with knowledge and understanding. One of their prominent endeavors, Grok, stands out from the rest by prioritizing inclusivity and user feedback. Grok goes beyond the ordinary AI tool by incorporating an individualized personality. It goes beyond information retrieval and offers a one-of-a-kind experience. With access to powerful search tools and real-time information, Grok is revolutionizing the way we interact with AI.

Some of the exciting research directions at xAI includes a focus on scalability and precision, exploring promising avenues such as tool-assisted oversight, integration with formal verification for safety and reliability, long-context understanding and retrieval, adversarial robustness, and multimodal capabilities. Their vision is to harness the immense potential of AI to create significant scientific and economic value for society. xAI is committed to developing reliable safeguards against malicious use, ensuring that AI continues to be a positive force for good.

Alta, helping you invest in the future

Artificial Intelligence (AI) has forever revolutionized the way we live, work, and communicate. To the extent that AI becomes an integral part of human life is still very much up for debate, with ethical, social, and political conversations surrounding the use of AI may very well change the level of involvement AI will have in our lives. What is clear is the impact it has on the business landscape. From autonomous vehicles to predictive analytics, AI is bringing unprecedented levels of efficiencies as it sweeps through industry.

The global market for AI in fintech is massive, projected to reach $61.3 billion by 2031. There are many innovative AI companies that are leveraging AI to create impactful solutions. By investing in AI, we can be part of the next wave of technological innovation that will transform our world in countless ways.

Investors today are spoilt for choice. For those looking to invest directly, especially into firms involved in the AI value chain, or whether you’d like to tap on an AI fund to take advantage of the diversified investment opportunities it offers, investors have a range of opportunities to harness the growth opportunities of AI.

Looking to find out more about opportunities in AI? Contact us at syndicate@alta.exchange today!