Australian Real Estate Private Credit: Your Pathway to APAC Investment Growth

There’s a reason why Australian real estate private credit currently is Australia’s number one investment class by annual investment volume. Today, the asset class is set for substantial growth underpinned by strong economic fundamentals; the increasing market share from private credit lenders continues apace as major banks gradually retreat from commercial real estate lending.

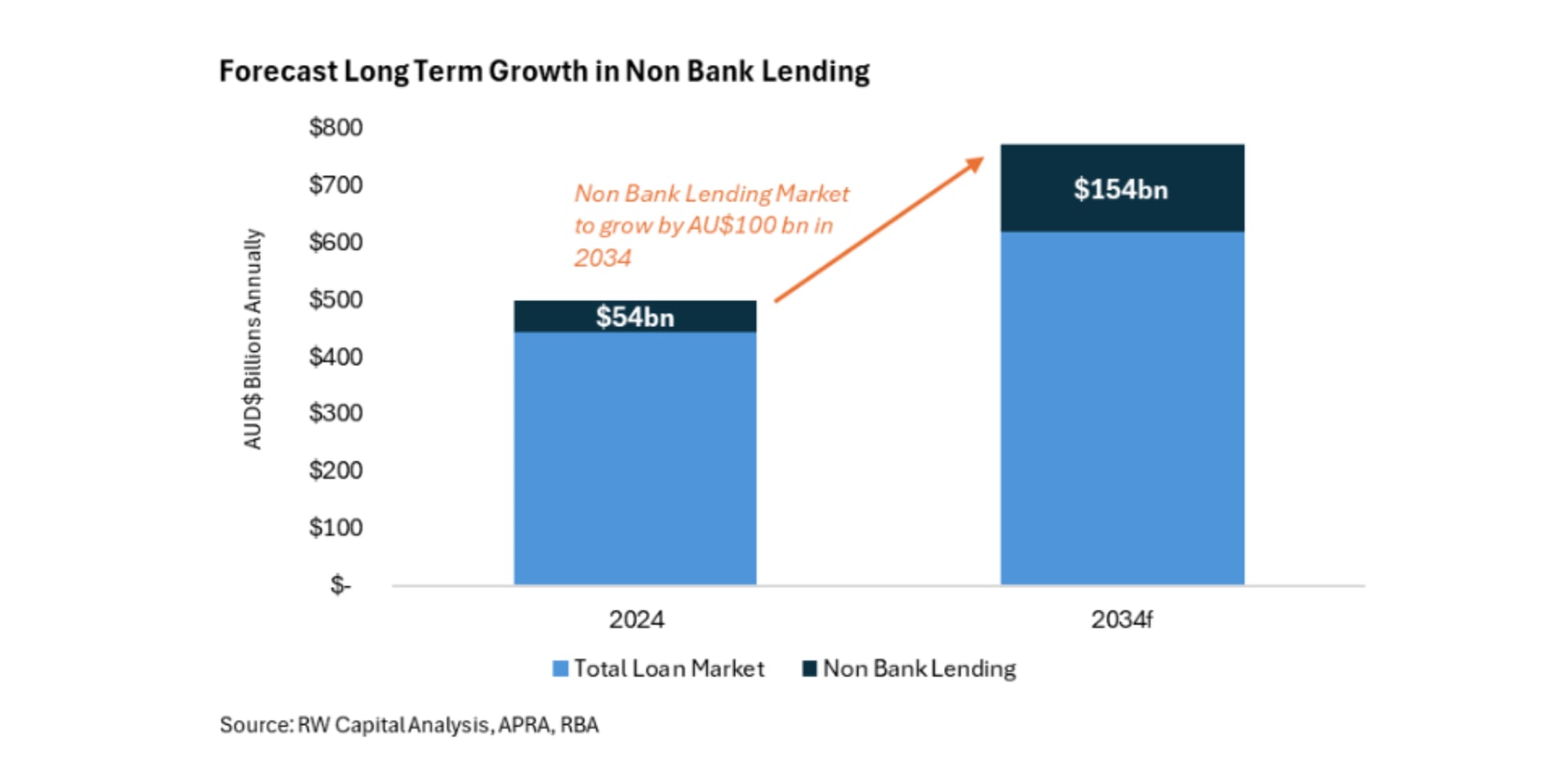

The pullback from banks is expected to create a $100 billion liquidity shortfall over the next decade, offering a unique opportunity for investors to participate in this attractive and robust sector.

This article is an excerpt of the full report from Ray White Capital. To access the full report immediately, simply fill up the form below and we will send the report to your email inbox.

Behind the Rise of Private Credit for Real Estate

As the Australian economy transitioned from low interest rates and steady growth into a period of higher volatility and elevated rates, private credit has become highly crucial and relevant for investors’ portfolio diversification.

Real estate private credit, in particular, is especially compelling within the private credit spectrum, offering higher risk-adjusted returns when compared to equity, shorter investment horizons, and steady cash flow.

The growing credit liquidity shortfall and the resilient Australian real estate market have created a favorable supply-demand dynamic, promising higher returns than equity investments in the near to medium term.

Experienced lenders who actively manage their portfolios are therefore well-positioned to capitalize on this evolving landscape.

Australia’s robust economic fundamentals, such as high population growth and well-regulated investment structures, support strong risk-adjusted returns in a high-interest environment. With a history of stable growth and a resilient real estate market, Australia offers unique advantages for private credit investors.

All these factors considered, the Australian private credit market provides significant structural protections, leading to resilience through economic cycles and delivering attractive returns not found in many other developed markets.

What is driving the growth in Australian Private Real Estate Credit?

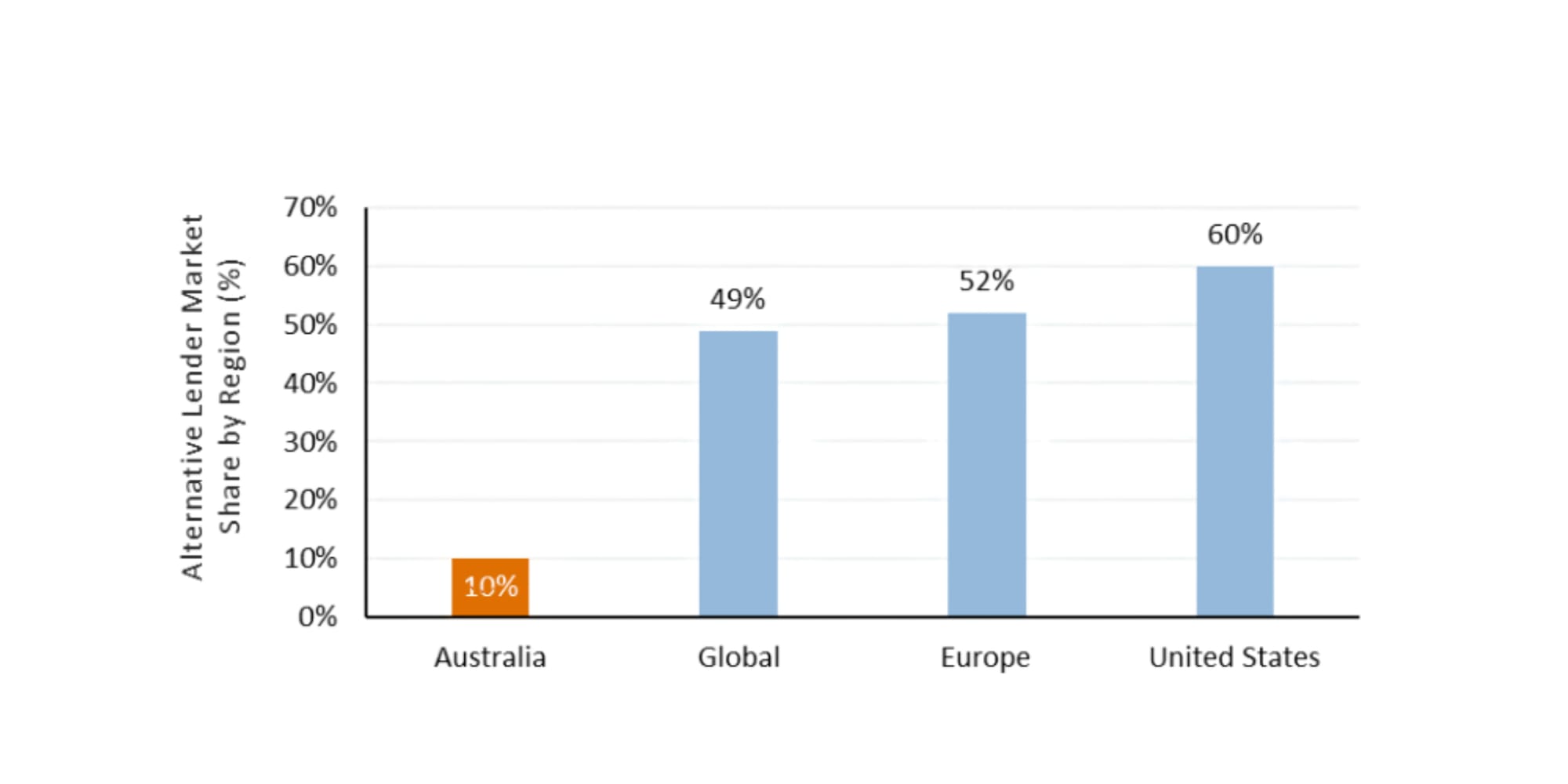

The Australian real estate lending market is predominantly controlled by major local and international banks, which hold almost 90% of the national loan portfolio. This contrasts starkly with the global average, where non-bank lenders account for 49% of the market, and in the USA, they dominate with over 60%.

This disparity in privately sourced credit presents a significant long-term growth opportunity for the sector. As major banks pull back from lending, a considerable liquidity gap is emerging in the commercial real estate loan market.

Given the current loan market size of $480 billion, shifting just 1% of loans from major banks to private credit requires an additional $5 billion in liquidity.

Projections suggest that with a conservative annual growth rate of 5% in the commercial mortgage market, and the share of non-bank lenders increasing from 10% to 20% over the next decade, the private lending market will need to find an additional $100 billion to meet demand.

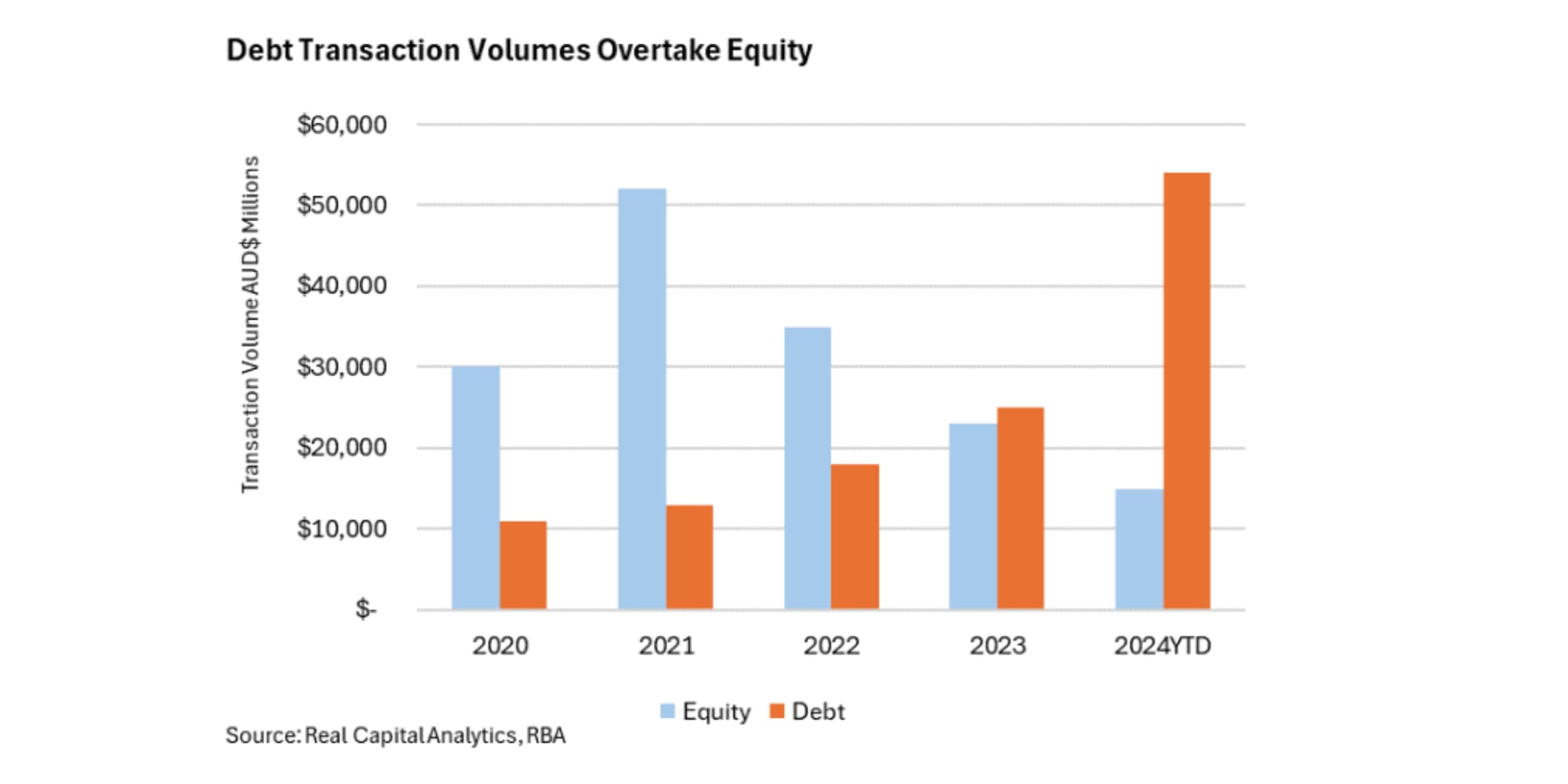

The recent downturn in real estate equity markets has led to record-low investments in the sector, with gross sales plummeting to $23 billion in 2023 from a peak of $53 billion in 2021, far below the 10-year average of $35 billion.

For the first time, private credit allocations in Australia have surpassed equity investments, with $25 billion allocated in 2023 and $54 billion allocated year-to-date in 2024. The non-bank real estate market is forecast to grow significantly, reaching over $154 billion by 2034.

With those trends setting the backdrop of the Australian real estate sector, here are several key factors that are further driving the rise of non-bank lending in Australia:

Higher Interest Rates: Central banks around the world – including Australia’s – are combating persistent inflation through higher rates. This shift favors alpha-led strategies over passive ones, enhancing the appeal of private credit.

Regulatory Changes: Stricter capital requirements and lending standards imposed on traditional banks post-global financial crisis have limited their lending capacity, particularly to riskier borrowers. Non-bank lenders, not bound by these stringent regulations, have capitalized on this opportunity.

Market Demand: There is strong demand for real estate financing in Australia, driven by both residential and commercial markets. Non-bank lenders provide flexible and tailored lending solutions, catering to borrowers who may not have access to traditional bank loans.

Investor Interest: In search of higher yields, investors are drawn to non-bank real estate lending, which offers attractive returns compared to other fixed-income investments. The tangible asset backing and relatively high yields make this a compelling option for income-focused investors.

Private Credit as a Hedge: With increasing volatility and declining returns in equity markets, private credit offers a defensive strategy, serving as a hedge against investment loss. Despite equity investments in Australian commercial real estate still accounting for over 85% of all capital deployed, private credit's appeal is growing.

How Does Australian Private Real Estate Credit Returns Compare Globally?

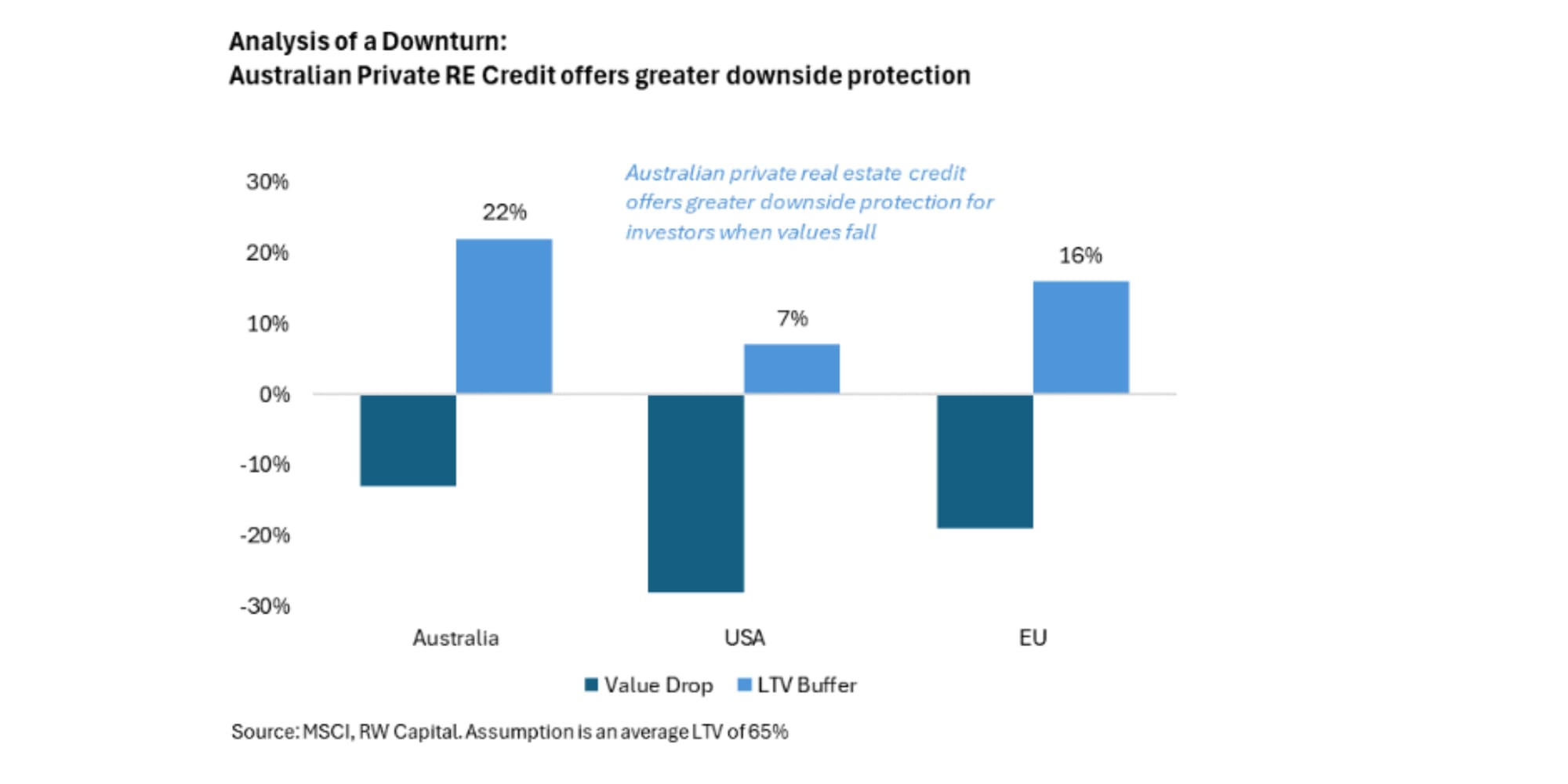

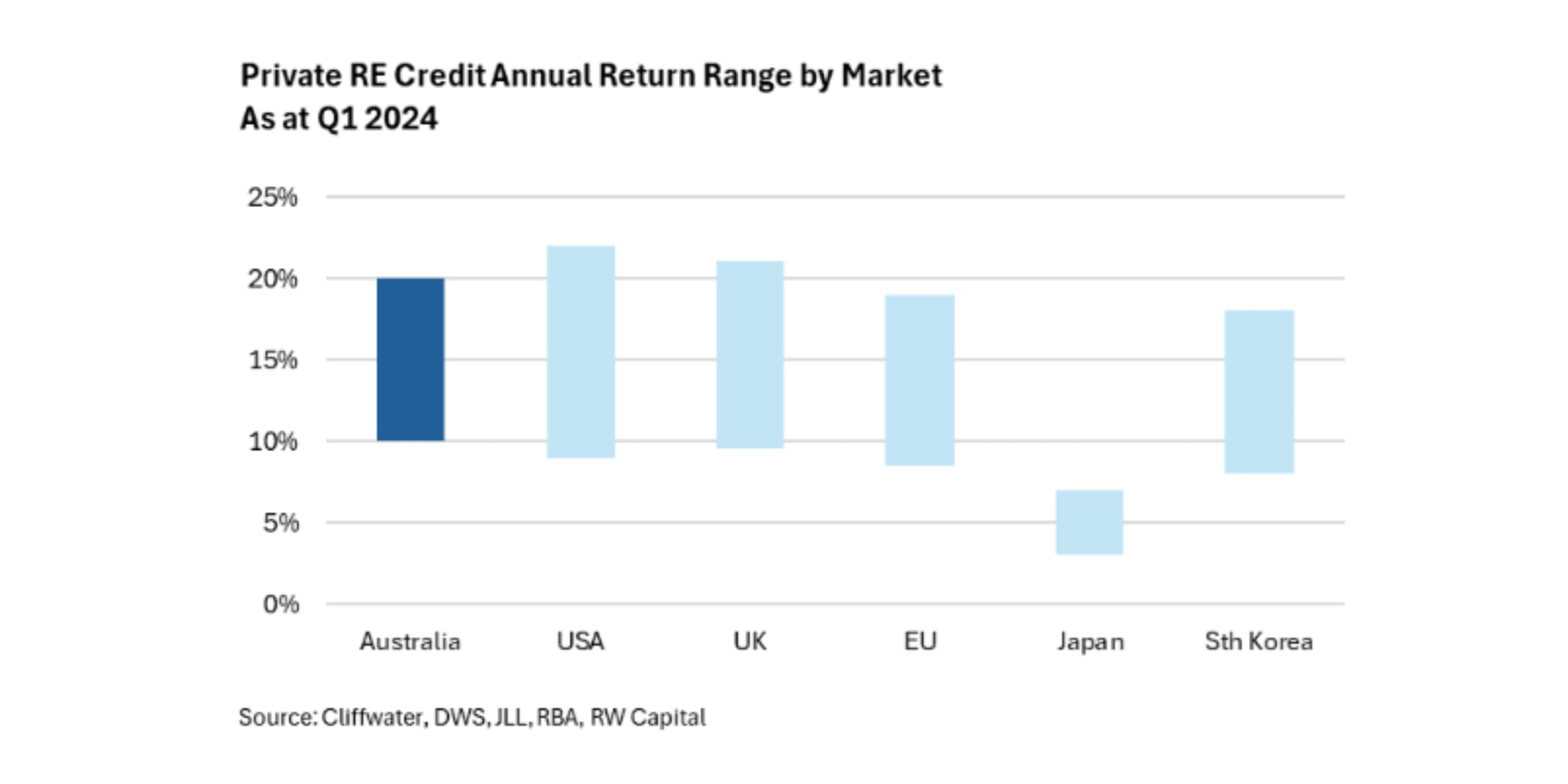

In comparing private real estate credit returns across major markets, including Australia, Europe, and the USA, a few notable trends emerge:

- Australia vs. Europe: Australia and Europe show similar return profiles, likely due to their comparable regulatory environments. However, potential rate cuts in the EU might create a divergence in returns over the next year.

- United States: The US market offers strong returns due to its size and deal flow accessibility. However, the market faces increased systemic risk from falling commercial real estate values and the potential for more distressed assets. An upcoming wave of commercial real estate refinancings in 2025-26 could further stress the market.

- Risk-Adjusted Returns: In Australia and other developed APAC economies, private credit returns are robust, averaging over 10% for senior credit. Higher-risk strategies, such as Junior and Special Situations, could yield returns exceeding 20% in the near term.

APAC vs. Country-Specific Strategies

Allocating capital in the Asia-Pacific region requires careful consideration due to varying levels of market depth, risk, and sophistication across countries:

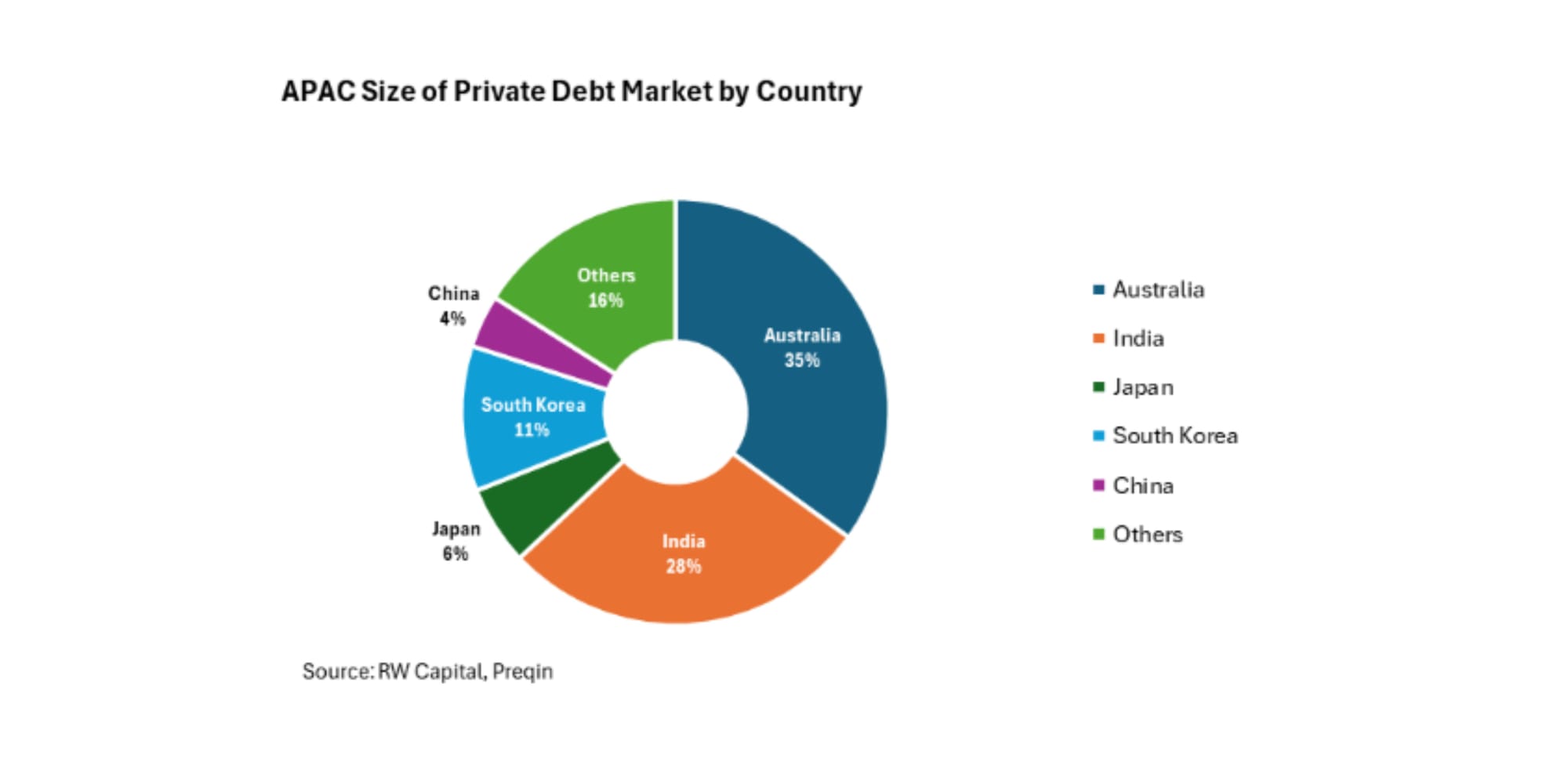

- Market Size and Investment Opportunities: Despite housing over 60% of the world’s population, the APAC region attracts only 10% of global capital for real estate private credit. Many economies in the region are still developing, lacking the regulatory frameworks and skilled investment professionals found in more mature markets.

- Challenges in APAC: Investment opportunities in high-quality real estate are limited, particularly in markets with government involvement or opaque private ownership. Countries like China and India, while large and fast-growing, present significant regulatory and governance challenges, increasing investment risk.

- Attractive Markets in APAC: Australia, Japan, and South Korea offer the best opportunities, with strong regulations and deep investment-grade markets. Singapore and Hong Kong also present potential, though their smaller and less liquid markets pose challenges.

As non-bank lending gains market share in APAC, the sector is maturing, expanding investment opportunities and delivering rising risk-adjusted returns. Australia, with its robust regulatory environment and solid economic fundamentals, stands out as a key market for private real estate credit within the region, making it a crucial component of any APAC-focused investment strategy.

Risk-Reward Profile of Australian Real Estate Private Credit

Non-bank lending in Australian real estate, which presents its own set of risks, offers significant rewards for savvy investors. Australia's low default and mortgage delinquency rates mitigate some risks, but deal specifics can still expose investors to considerable downsides if not properly managed. Here’s a brief overview of key risks and rewards:

- Credit Risk: Non-bank lenders cater to higher-risk borrowers, increasing default likelihood. However, loans secured against real estate provide a safety net for investors.

- Market Risk: Returns depend on the real estate market's health. Economic downturns, property value changes, and interest rate fluctuations can impact loan performance. Diversification and prudent risk management are crucial.

- Regulatory Risk: Changes in regulations, like the upcoming Basel III capital requirements, could drive banks to lower-risk products, increasing the liquidity gap. Staying informed on regulatory changes is essential, especially as most Australian commercial real estate loans are bank-held.

- Liquidity Risk: Non-bank lending investments are less liquid than publicly traded securities, making quick cash conversions challenging. However, higher returns can offset this liquidity issue.

- Operational Risk: Issues in loan origination, servicing, and collection pose operational risks. Effective management and strong governance are critical. Experienced debt managers play a vital role in mitigating these risks.

- Construction Risk: Rising construction costs and inflation make it challenging for developers to commit to fixed-price contracts, squeezing margins and increasing risks.

- Back Leverage: Some funds use "back leverage" to amplify returns, increasing downside risks and reducing investor protections in case of defaults.

- Open-Ended vs. Closed-End Funds: Open-ended funds allow frequent redemptions but can lead to volatility and diluted returns. Closed-end funds offer greater control and liquidity as loans mature and are repaid.

Managing Investment Risks in Australian Private Credit

With Australian REITs trading at an average 20% discount to book value, there is a clear indication of potential overvaluation and skepticism about asset valuations.

Recent transactions, particularly in Sydney's office market, have shown assets trading significantly below their peak and recent valuations. This uncertainty highlights the elevated risks in the underlying assets. For debt investments, this valuation gap impacts the loan-to-value ratios (LVRs), affecting the perceived security of loans and potentially leading to higher risks of value destruction.

A key takeaway for private credit investors is the importance of independently assessing the true market value of underlying assets. Reliance on book valuations without thorough market analysis can lead to incorrect deal pricing and increased risk. Speaking with local market experts and analyzing comprehensive transaction data are essential steps in mitigating these risks.

Private credit investors are achieving higher returns by restructuring existing loans, particularly in senior and first mortgage deals. By securing loans with more accurate valuations and adjusting terms to reflect current market conditions, lenders can realize opportunistic returns with enhanced security. This approach underscores the importance of accurate asset valuation and prudent risk management in maximizing investment returns in Australian private credit.

The Australian private credit market provides significant structural protections, leading to resilience through economic cycles and delivering attractive returns not found in many other developed markets. Get in touch with us today to seize the moment and capitalize on this trend.

This article is an excerpt of the full report from Ray White Capital. To access the full report immediately, simply fill up the form below and we will send the report to your email inbox.

The insights provided in this article belong to Luke Dixon, Head of Research & Institutional Capital at Ray White Capital, as detailed in his research paper, “The Sweet Spot in APAC Investment Strategies.”