Demystifying Private Credit

With more firms eschewing IPOs to stay private for longer, a new market for investing in non-traditional forms of credit is quickly taking hold. In our report, we look at what private credit is, what it entails for investors, and what’s exciting investors in this fast-growing asset class.

What is Private Credit?

Private credit is defined as non-bank lending where the debt is not issued on the public markets. This type of credit typically involves investments in unlisted debt securities or direct lending to borrowers. It may offer higher returns than traditional fixed-income investments, but also carries greater risk.

Private credit has risen in popularity in the last five years among family offices. UBS publishes a survey of family offices annually. The 2022 UBS Global Family Office Report states that 27% of the investors are taking on private debt. In 2017, the proportion was 8%.

The appetite for private credit among family offices is set to rise. A survey conducted by Alternative Credit Council estimated that 50% of family offices plan to increase their private credit exposure. This is an asset class whose time has come.

Types of Private Credit

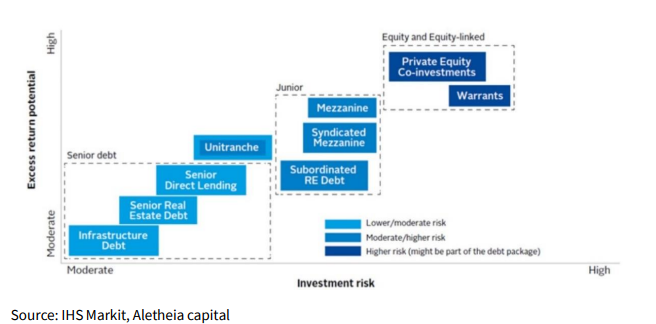

There are several categories of private credit:

- Direct Lending is a financing method for borrowers to raise funding without going through banks. The platforms include peer-to-peer sites or direct interaction between parties. The benefit of direct lending is that it provides alternative financing sources. Lenders can also generate a higher return.

- Senior Debt commands a higher priority to other forms of lending. Under the regulations, it has to be paid off before other forms of debt financing in a bankruptcy. It is not as risky for the lender. The interest rates tend to be lower than other forms of financing, such as subordinated or mezzanine debt.

- Mezzanine financing refers to subordinated debt or preferred equity instruments. This form of financing is senior to common equity. It can be structured debt or preferred stock. The interest rate on mezzanine financing is higher than that of senior or secured debt.

- Special Situations are investment opportunities that involve corporate events such as mergers, liquidations, litigation and demergers. Examples of special situations can include bankruptcies, capital structure dislocations, shareholder activism and buybacks.

- Distressed Debt refers to financial assets (such as bonds or loans) whose issuers are facing financial distress, such as default. This type of debt is risky and offers a higher yield to investors as compensation for the added risk.

- Venture Debt is a type of financing provided to startups and early-stage companies through a loan. This type of debt typically has a higher interest rate than traditional debt and is secured by the company's assets and future revenue.

What are the investment merits of Private Credit?

From the potential for higher returns to better diversification options, private credit can offer various benefits leading to portfolio enhancement.

- Vast Untapped Market - Private credit provides massive opportunities. Traditional sources of lending have taken a back seat in many sectors. The contribution of traditional lenders such as banks has diminished in the last decade. Private credit providers like nonbank lenders have stepped into the fray. Similarly, there is a vast gap in traditional funding in the buyout credit market.

- Flexibility - Private credit providers often have flexibility in their lending criteria. This applies to loan structures, and underwriting processes compared to traditional banks. It is easier for borrowers to secure financing for unique or complex situations.

- Speed - Private credit providers can make quicker decisions and fund loans faster than traditional banks, placing it at an advantage for borrowers with urgent needs.

- Less regulatory restrictions - Private credit providers are not subject to the same regulatory restrictions as banks, allowing them to offer loans with more favourable terms and lower costs.

- Diversification - Investing in private credit can offer diversification benefits for investors. It can provide exposure to a different asset class with low correlation to traditional investments such as stocks and bonds.

- Yield enhancement - Private credit can offer higher yields compared to traditional fixed-income investments, making it an attractive option for yield-seeking investors.

Private Credit Fund Managers

Globally leading fund managers have launched private credit funds to help investor get easy access to this space. Here we have We have listed an array of such fund managers:

Hamilton Lane Partners

Hamilton Lane is a leading, global investment manager providing private debt markets solutions that help the clients accomplish their unique financial goals. It has US$823 billion in AUM. It has invested exclusively in private markets for the last three decades. It has US$ 576m invested alongside the clients.

It launched the Hamilton Lane Senior Credit Opportunities Fund in November 2022. It has a target return of 8-10%. The fund has an open ended RAIF structure with monthly liquidity. Its target yield is 4-8%.

Blackstone Credit

With more than $153 billion in AUM as of September 2021, Blackstone Credit is one of the largest private debt fund managers in the world. They invest across the credit spectrum, including corporate credit, real estate debt, and structured credit.

Ares Management

Ares Management has more than $159 billion in AUM and is one of the largest private credit managers globally. The firm invests across a range of credit strategies, including direct lending, distressed debt, and special situations.

GSO Capital Partners

GSO Capital Partners is a subsidiary of Blackstone Group and has over $140 billion in AUM. The firm invests in a variety of credit strategies, including leveraged loans, high-yield bonds, and mezzanine debt.

HPS Investment Partners

HPS Investment Partners has over $67 billion in AUM and specializes in credit investments across a range of industries and geographies. The firm invests in strategies including mezzanine debt, distressed debt, and specialty finance.

TPG Sixth Street Partners

With over $42 billion in AUM as of September 2021, TPG Sixth Street Partners invests across a range of credit strategies, including direct lending, distressed debt, and special situations.

Venture Debt Funds

Venture debt funds are a category within private credit funds. Venture debt is attracting attention in Asia. APAC-based venture debt AUM has risen to $3.9bn, as of March 2022. This is double the December 2019 level. Venture debt disbursed in APAC in 2021 was $12.1bn. This was four times the 2018 level of $3.2bn. The use of venture debt in emerging market tech is a nascent business. It applies to companies that are yet to generate revenue or have not achieved cashflow positivity.

Some of the features of a typical venture debt deal include the following:

- Interest Rate: Venture debt generally carries a higher interest rate than traditional bank loans. This is in accordance with the risk involved in this asset class.

- Warrants or Equity Kickers: Venture debt providers may also receive warrants or equity kickers in the borrower company. This provides the right to purchase equity at a predetermined price. The lender gets a stake in the upside potential of the borrower's growth.

- Flexible Terms: Venture debt providers may offer flexible repayment terms, such as interest-only payments or delayed principal payments. The aim is to match the borrower's cash flow needs.

- Minimal Dilution: Venture debt financing allows companies to raise capital without diluting ownership, as is typically the case with equity financing. This can be an attractive option for companies that want to retain control and ownership while still raising capital.

- Collateral Requirements: Venture debt providers may require collateral, such as intellectual property or accounts receivable, to secure their investment.

- Covenants: Venture debt providers may include certain covenants in their investment agreement, such as financial performance metrics, restrictions on additional debt or equity financing, or limitations on management compensation, to protect their investment and manage risk.

The advantages of venture debt are

- It does not dilute the controlling shareholder’s stake. It could be structured as a term loan or a line of credit. The loan provisions would include certain provisions to make sure that the company fulfills its obligations.

- Venture debt has a lower interest rate than conventional debt.

- It does not involve the costs of a full equity raise

Risk Analysis of Private Credit

- Private credit is an attractive asset class. It is not without significant risks. Investors need to factor these risks in their investment considerations.

- Credit Risk: Private credit investments typically carry a higher risk of default than traditional bank loans due to the higher credit risk associated with lending to startups and emerging companies.

- Liquidity Risk: Private credit investments are typically illiquid. This means that investors may not be able to sell their investment easily or quickly. This lack of liquidity can make it difficult for investors to exit their investment, particularly in the event of a default or other adverse event.

- Interest Rate Risk: Private credit investments are often subject to interest rate risk. Changes in interest rates can affect the value of the investment. Rising interest rates can reduce the value of fixed-income securities and increase borrowing costs for borrowers, potentially leading to default.

- Operational Risk: Private credit investments can be subject to operational risks. The operational issues include fraud, mismanagement, or other operational issues that can negatively impact the borrower's ability to repay the loan.

- Regulatory Risk: Private credit is subject to less regulation than traditional bank lending. Bank lending can create regulatory risk.

Private Credit with Alta

The size of the private credit market has tripled to US$1.2 trillion between 2012 and 2022, according to estimates. Private credit may be on a cusp of a further boom in a rising rate and inflationary setting. The asset class may serve its core purpose of superior yields, lower volatility, and diversification.

Alta's exclusive event The Golden Age of Private Credit event at Spectrum DUO Tower brought together thought leaders from key markets who weighed in on the growing private credit market, sharing their perspectives on strategies that are defining the current wave of opportunities in private credit.

Alta's exclusive event The Golden Age of Private Credit at Spectrum DUO Tower

In Emerging Asia, venture debt may be at the heart of the private credit opportunity.

This is an excerpt of Aletheia Capital's "Asset Class Survey: Private Credit Sector Report", April 2023. For the full report, please reach out to us at enquiry@alta.exchange.