Private Equity Secondaries: Year in Review 2023

In the dynamic landscape of private equity, change is the only constant, bringing with it a blend of challenges and thrilling prospects. Delving into the insights provided by the Preqin Global Report, it's evident that secondary funds are poised to amplify their presence, marking a significant shift in market dynamics. Moreover, with the anticipation of heightened transaction volumes as the price discovery process unfolds, the stage is set for a riveting journey ahead.

Join us as we take a closer look at the year that was in Private Equity Secondaries, exploring the trends, transformations, and tantalizing opportunities that shaped 2023.

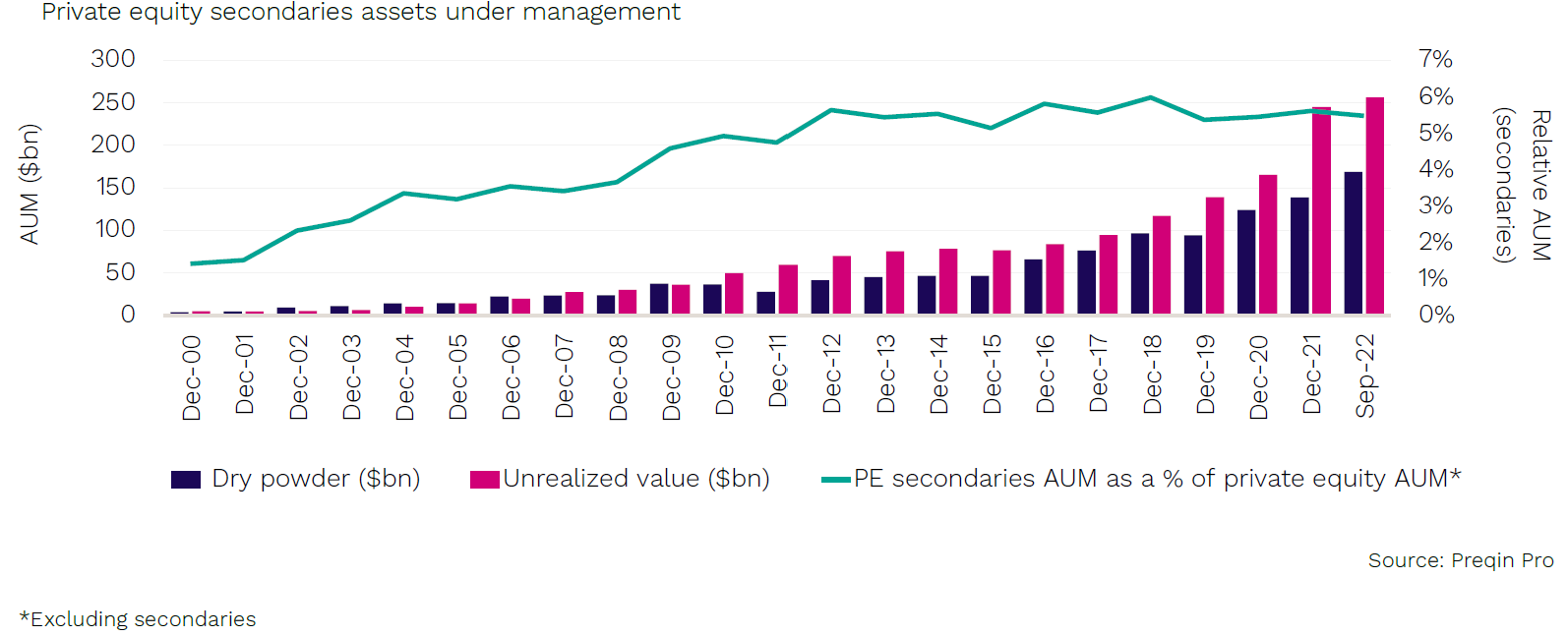

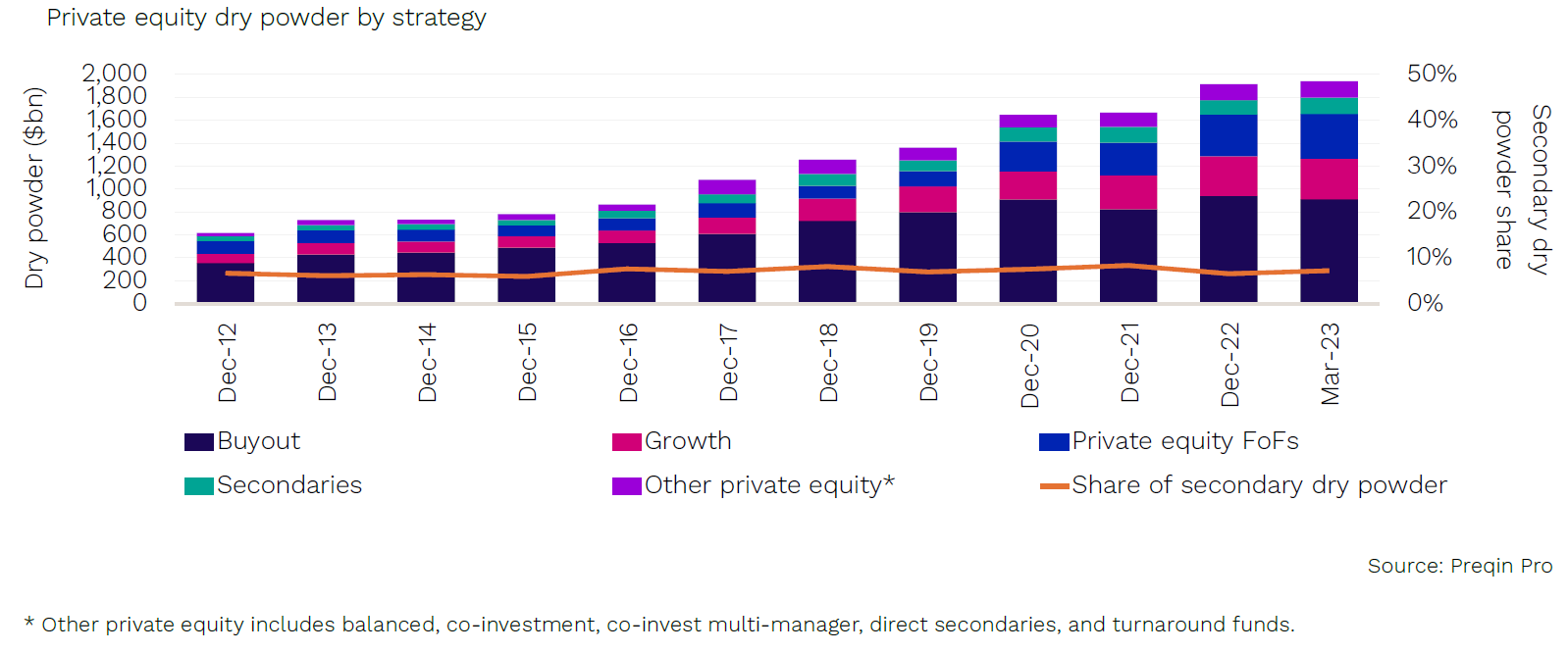

Secondary funds set to grow market share

The secondary funds market is poised for growth, with an anticipated increase in transaction volume once the price discovery process concludes. This demonstrates the maturation of the private equity secondaries market, driven by structural factors that influence the flow of secondaries deals. Additionally, LPs can take advantage of opportune moments to streamline their investments, while GP continuation funds can help counter the challenges of fundraising. Lastly, LPs have the ability to mitigate the J-curve effect in the primary market. Overall, these developments point towards a promising future for the secondary funds market.

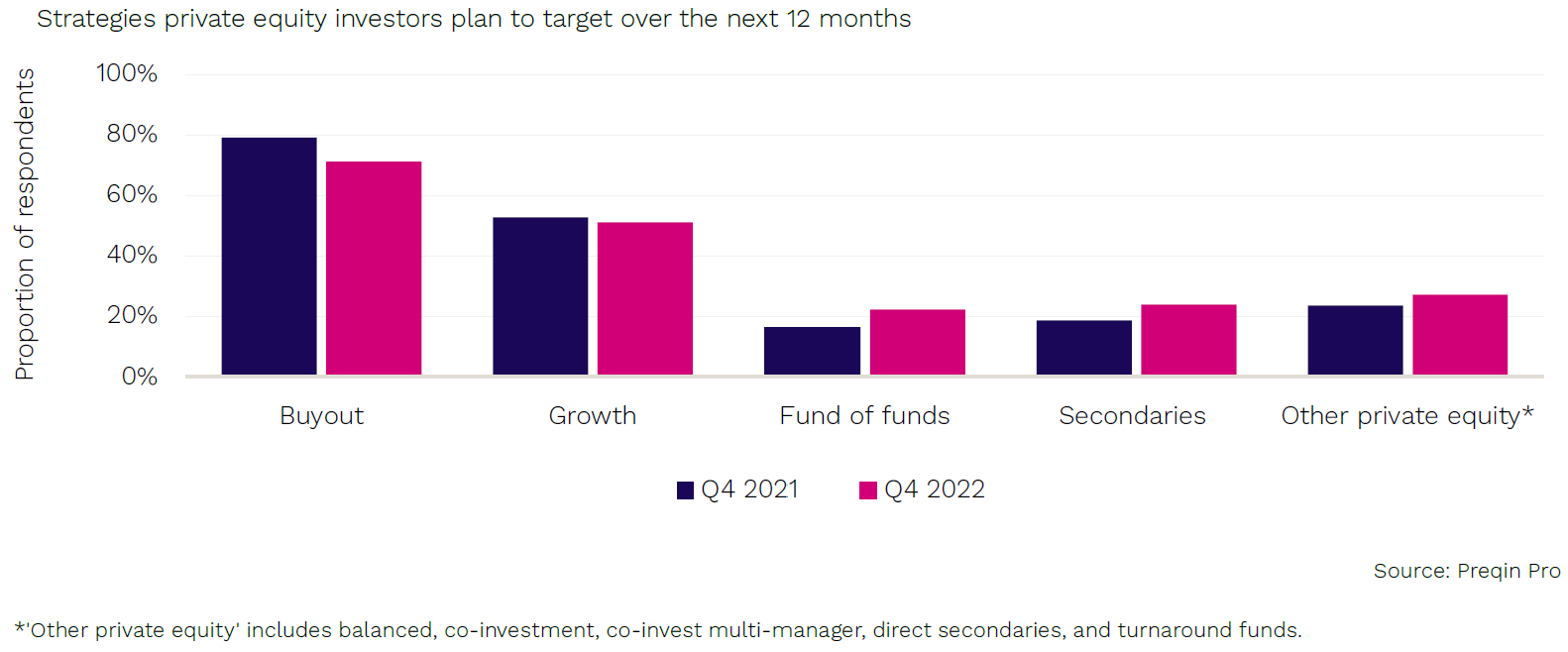

Secondary fundraising draws in more LPs

The secondary fundraising market is attracting a larger number of limited partners (LPs). Not only are LPs looking to sell their private equity exposure in the secondary market, but there is also an increase in demand from LPs who want to invest in secondary fund strategies themselves.

- Early investors. This growing demand to participate in these new secondary funds is coming from a diverse group of investors, including early investors who see it as a way to offset the J-curve effect in their investment programs. Investment committees who are less experienced with private equity are particularly drawn to secondaries investments for this reason.

- Private wealth. Private wealth investors are increasingly interested in private equity secondary funds. However, there is a potential concern that investors may end up paying high prices for exposure, despite pricing discrepancies between public and private markets. Nonetheless, the development of distribution channels into the private wealth space is expected to drive fundraising in private capital markets.

- LPs redeploying capital from mature to new vintages. Despite the current challenges in financial asset prices, investing in new opportunities may be a wise decision in the long run. With cautious deployment of capital and limited competition in the market, investments made now have a higher likelihood of performing well compared to previous investments. Some investors are eager to reallocate funds from mature investments to capitalize on new opportunities.

Fundraising, dry powder, and deal flow

The performance of private equity secondary funds has been impressive, especially when compared to the overall performance of private equity. However, it is important to approach the more recent vintages with some caution. If fund interests are acquired at a discount to net asset value (NAV) early on, it can result in a high internal rate of return (IRR) when those positions are marked back to fair value in the portfolio. However, it is worth noting that these high returns may not continue as the portfolio matures.

Predictions

- The rise of venture capital secondaries: keeping pace with a growing industry. As the venture capital market continues to expand, so does the secondary market for this booming asset class. In fact, the secondary market has seen even faster growth as private markets thrive. Over the past three years, venture capital has experienced a remarkable threefold increase in total assets under management, skyrocketing from $0.79tn to an impressive $2.2tn. This surge in the industry presents exciting opportunities for investors and underscores the significance of venture capital secondaries in today's financial landscape.

- Benefits for LPs selling to secondary fund managers. Diversify your holdings by rolling an LP stake into a secondary fund, gaining liquidity and exposure to refresh your portfolio. Direct secondary funds also offer a new avenue for investors to find liquidity on their direct investments in VC companies. These innovative solutions are crucial for VC investors seeking to maintain their target mandates.

- Benefits for LPs investing in VC secondary funds. Investing in secondary funds has become increasingly important in the venture capital (VC) industry. In addition to their traditional benefits, such as mitigating the J-curve, secondary funds offer a solution for the growing trend of longer VC exits, which tie up capital in portfolios. By investing in VC investments that are already a few years in, secondary funds offer a shorter time to realized cashflows. Furthermore, secondary funds provide an opportunity to establish a diverse portfolio across different generations and strategies, while also allowing for the development of expertise in newly established portfolio programs.

According to Preqin, the assets under management (AUM) of venture capital (VC) are projected to increase from $2.5 trillion in September 2022 to $4.2 trillion by 2027. This growth is expected to create favorable conditions for pure-play VC secondary funds in the coming years, making it an attractive investment opportunity.

To view the full Preqin report, sign up as an accredited investor with us now!