Private Equity: Year in Review 2023

As we reflect on the past year, it's clear that despite the challenges and uncertainty brought about by global events, alternative investments continue to be a lucrative and attractive option for investors.

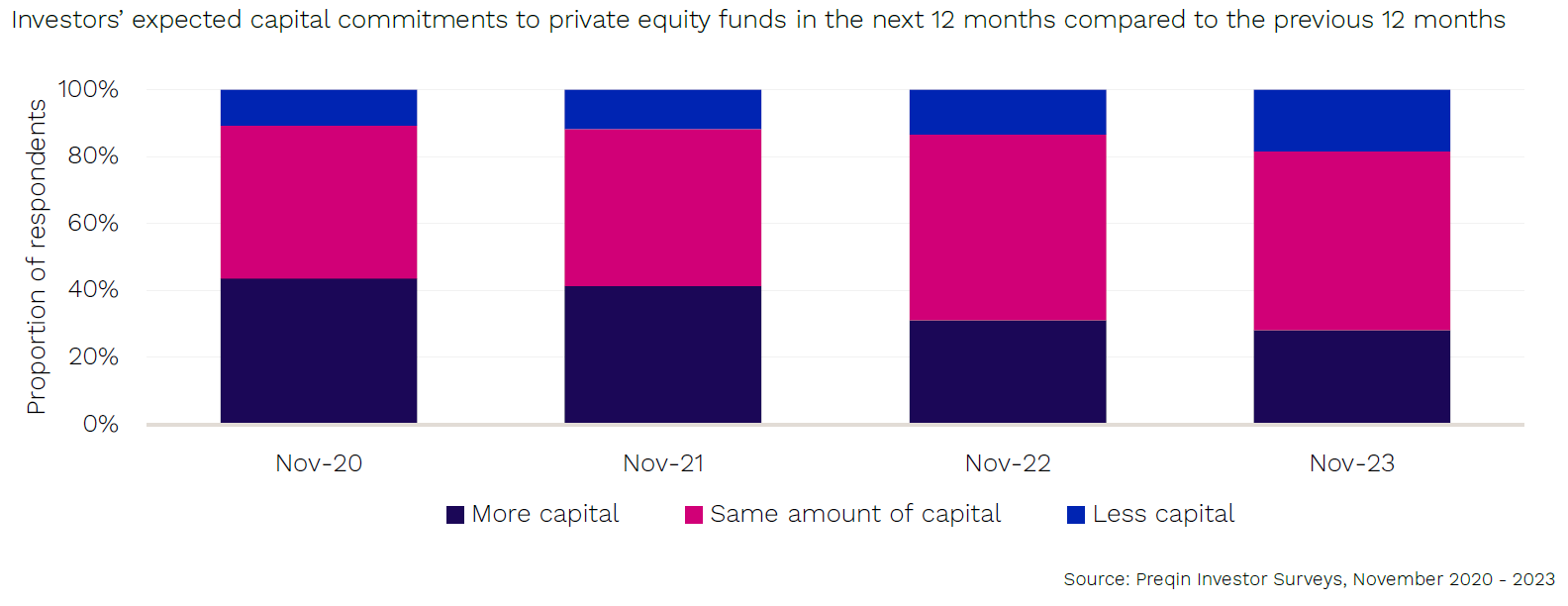

The latest investor and private equity fund manager survey from Preqin indicates that sentiment may be weakening, but there is still strong interest in both the short and long term.

Alta has been at the forefront of this paradigm shift, as more and more investors turn towards innovative platforms like ours to access niche investment opportunities.

In this blog post, let's delve into Preqin's key insights from 2023 that shaped the landscape of private equity investments and what might lie ahead for private equity investing in 2024!

Key Findings

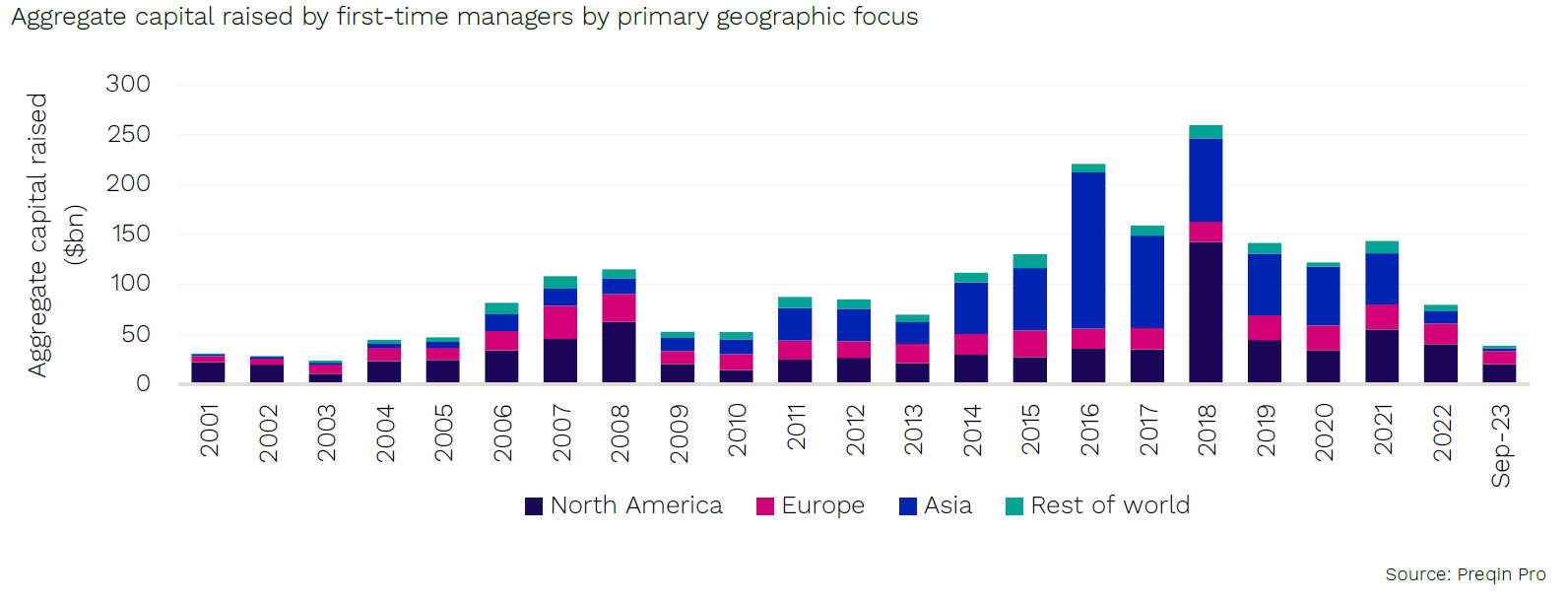

- Fundraising Adapting to Changing Winds: Despite facing headwinds, fundraising efforts have shown resilience and adaptability.

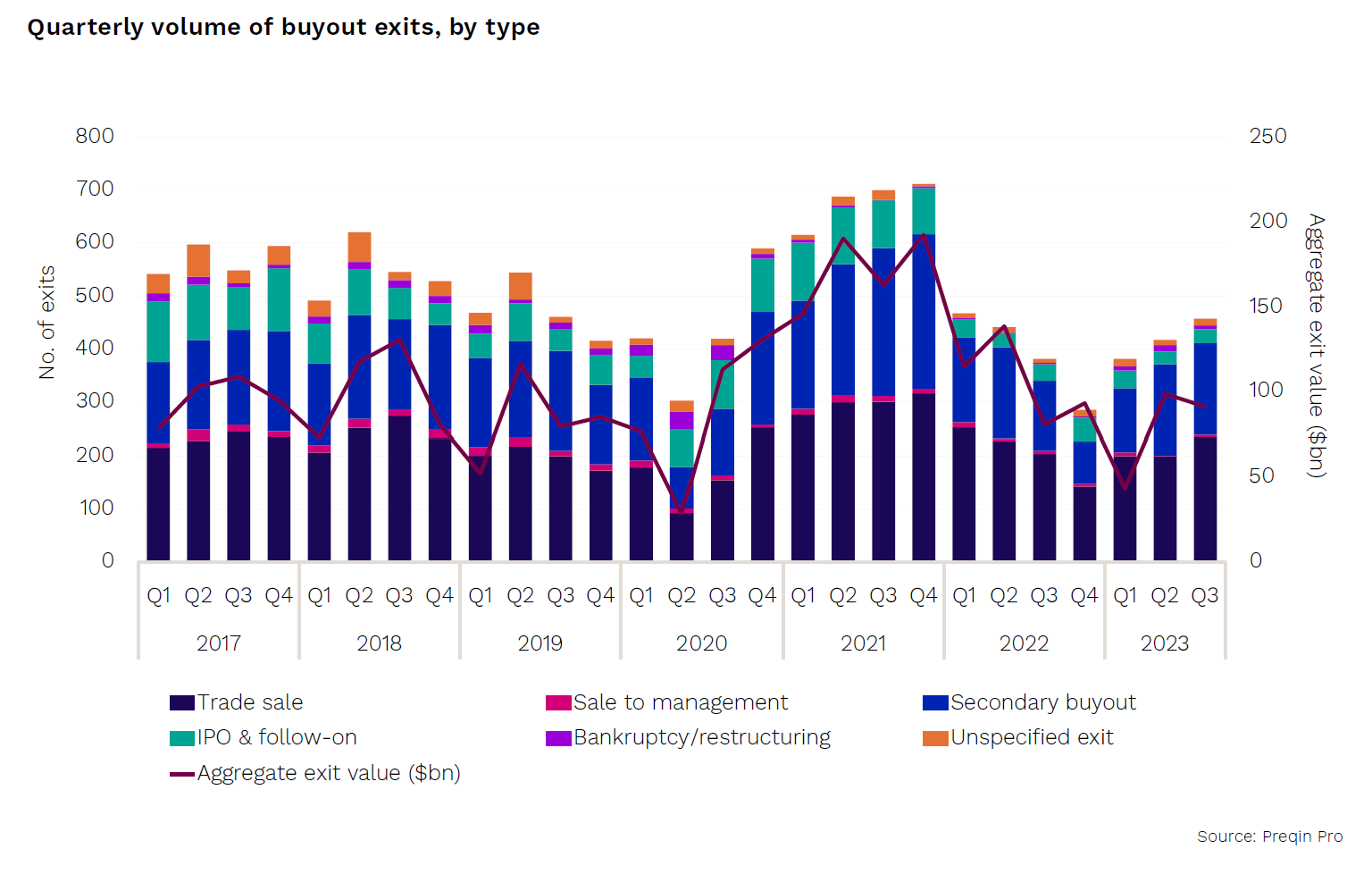

- Exit Freeze Showing Signs of Thawing: Encouragingly, the freeze on exits may be slowly lifting, offering potential opportunities for investors.

- Secondaries: An Untapped Potential: The secondaries market is poised for growth, with promising developments on the horizon.

- Inflection Point in Private Wealth Fundraising: Private wealth fundraising is reaching a pivotal moment, presenting new avenues for investors to explore.

Key Figures

✨ $508.6bn -> Total aggregate capital raised for final closes to Q3 2023

✨ 5,438 -> Number of deals in the first 9 months of the year

✨ $232.4bn -> Total aggregate exit value for the year to Q3 2023

✨ -4.5% -> One-year net IRR returns to March 2023

Private equity returns face stern test

The financial markets in 2023 were still grappling with the effects of the pandemic stimulus and the shifting geopolitical landscape. Unlike the prolonged quantitative easing that followed the Global Financial Crisis in 2008, the stimulus measures implemented in 2020 and 2021 not only inflated asset prices but also led to inflation in the real economy. This unprecedented level of stimulus had a significant impact on private equity markets, causing a surge in activity.

Fundraising, deals, and exits reached record highs, driven by the infusion of capital into the system. However, excessive activity within the system, exemplified by the SPAC phenomenon, resulted in many deals plummeting by as much as 90% from their peak.

Despite these challenges, private equity and venture capital saw a period of remarkable performance, reaching a peak in December 2021 with three-year rolling performance.

Market dislocation drives secondaries

Secondaries saw increased transaction volume as price discovery unfolded. This increased activity is expected to continue well into 2024 (as of March 2023, private equity secondaries represent 8% of total private equity assets under management).

This growing demand is coming from all manner of investors, including early investors, private wealth individuals, and limited partners (LPs) reallocating capital from mature to new investment opportunities.

"Secondaries saw increased transaction volume as price discovery unfolded. This increased activity is expected to continue well into 2024 ."

Long-term investor appetite remains strong

Secondary investments have now overtaken small-mid market buyouts as the preferred strategy. The once sought-after growth equity strategies have seen a decline in interest due to their greater vulnerability to economic fluctuations.

What's Ahead in 2024 for Private Equity?

- The private wealth sector is experiencing significant growth. Anticipate a shift in fundraising sources away from institutional forms of capital raising towards non-institutional ones. This change presents a promising opportunity for the private wealth segment, including family offices. Unlike many institutional investors, these entities have not yet reached their long-term private equity asset allocation targets. Additionally, B2B platforms that facilitate transactions between general partners and private wealth managers have been gaining momentum. Overall, we expect the private wealth space to thrive in the coming years.

- Mid-market to command interest. Expectation of sustained investor interest in the private equity mid-market buyout space remains high. Unlike larger strategies, these mid-market strategies employ fewer levels of leverage and rely less on the IPO channel as an exit option. The return on investment for these strategies is influenced by increasing valuation multiples, which can be achieved through buy-and-build strategies rather than relying on declining discount rates to command a higher valuation multiple upon exit.

"... [a] promising opportunity for the private wealth segment, including family offices."

- The rise of mega-managers is predicted to continue as the market faces more challenges. This will likely lead to a wider range of returns between different managers. In terms of fundraising, we anticipate a growing divide between managers. Those with established platforms and strong connections to investors will continue to thrive, thanks to the momentum they have built. On the other hand, smaller managers with less unique offerings may struggle in this competitive environment.

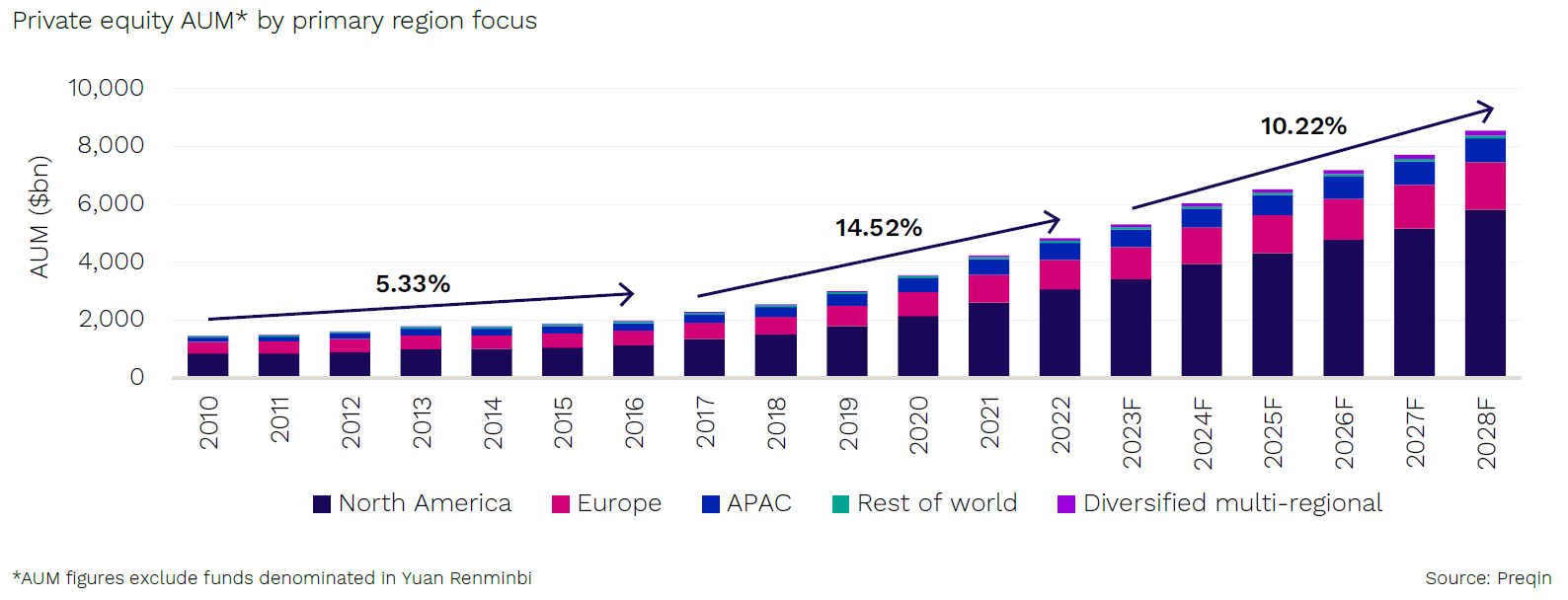

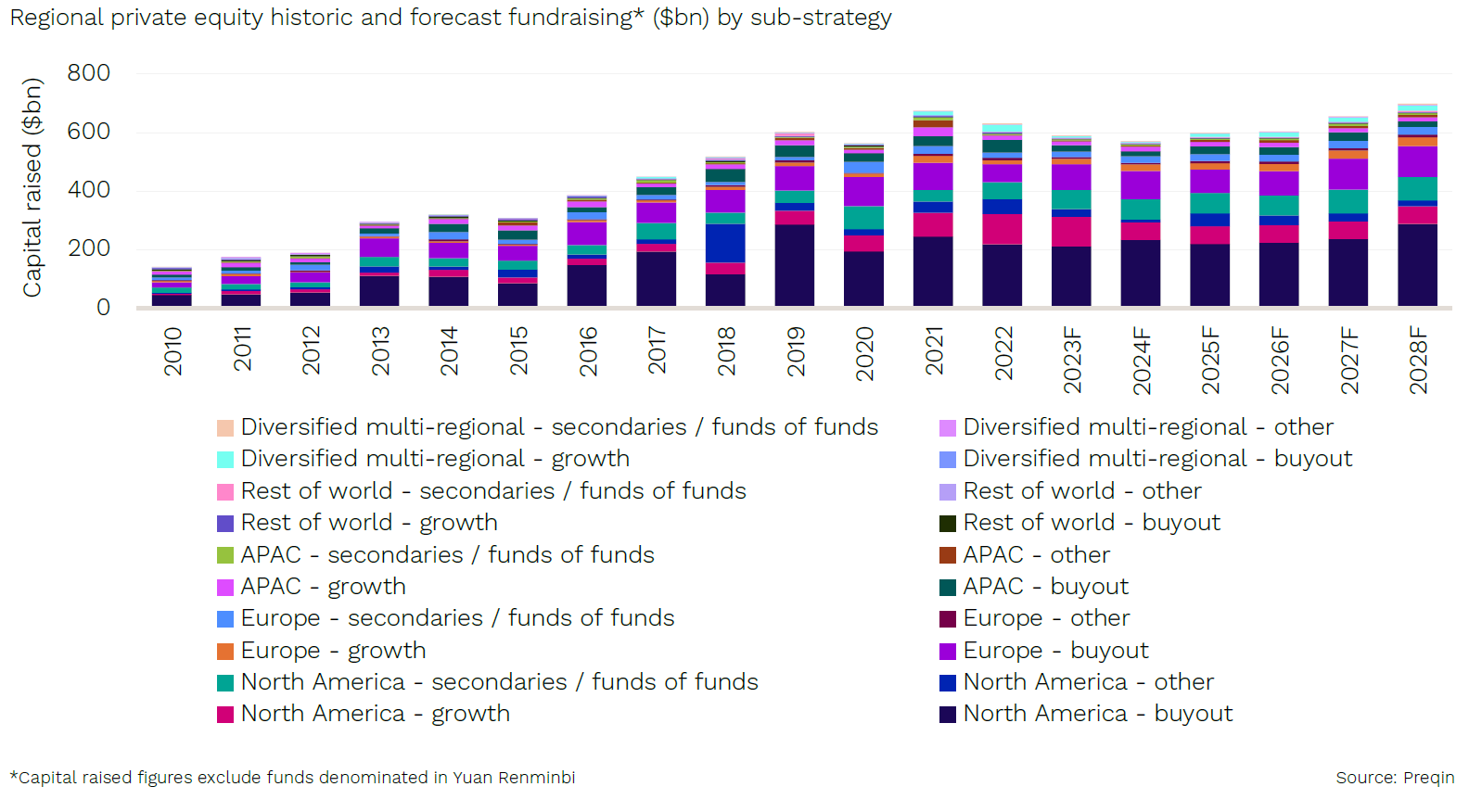

- North America to shine over Europe. In recent years, North America has been a standout performer in both public and private equity markets. And according to our forecast, this trend is set to continue until 2028F. While we have adjusted our returns expectations across the board, North America is still expected to outperform other regions with impressive returns of 13.95%. Despite mounting global geopolitical risks, the United States is positioned well compared to Europe. The US economy remains strong, although there are concerns about rising fiscal risks due to a decline in capital gains tax receipts. Additionally, interest payments on outstanding debt are increasing, which is a factor that contributed to Moody's negative outlook on US sovereign debt. Overall, North America is the region to watch in equity markets, with its favorable economic prospects and potential for higher returns.

To view the full Preqin report, sign up as an accredited investor with us now!