Venture Debt: At the Heart of Asia's Private Credit Wave

Today, venture debt is well known in the US and Europe. In Asia, where venture debt remains relatively nascent, may provide fertile ground for this emerging class of private debt.

In a recent chat with Benjamin Twoon, Co-founder & Chief Commercial Officer of Alta, Ankit Agarwal, Director, Venture Debt of Lighthouse Canton shared that venture debt has been fairly common in more mature markets like the US, where it has thrived for over 50 years.

Many globally leading companies such as Facebook, Airbnb, Uber, YouTube have taken venture debt at some point in time of their growth journey.

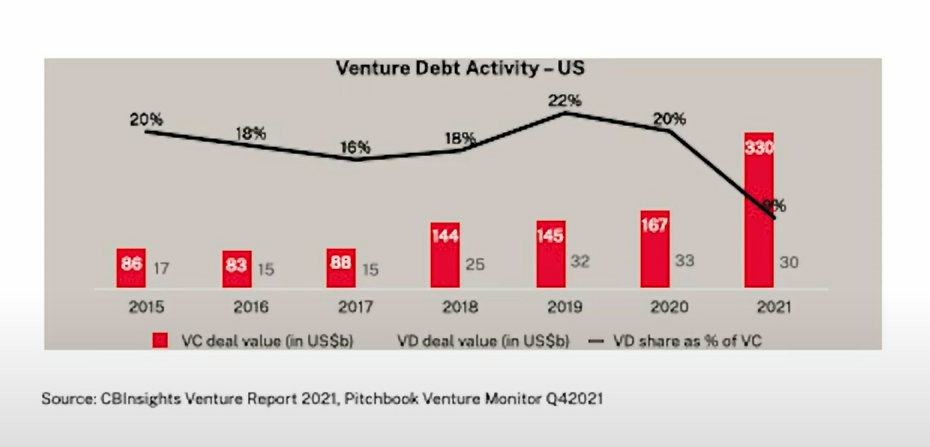

In the US itself close to US$30 billion of venture debt has been invested every year from 2019-2021. Venture debt contributed 18%-20% of the total VC funding in the region. In Europe, Venture debt has been present for over 20-25 years and in terms of scale, it matches its US counterpart and contributes a significant percentage of the total VC funding.

The Venture Debt Scene in Southeast Asia and India

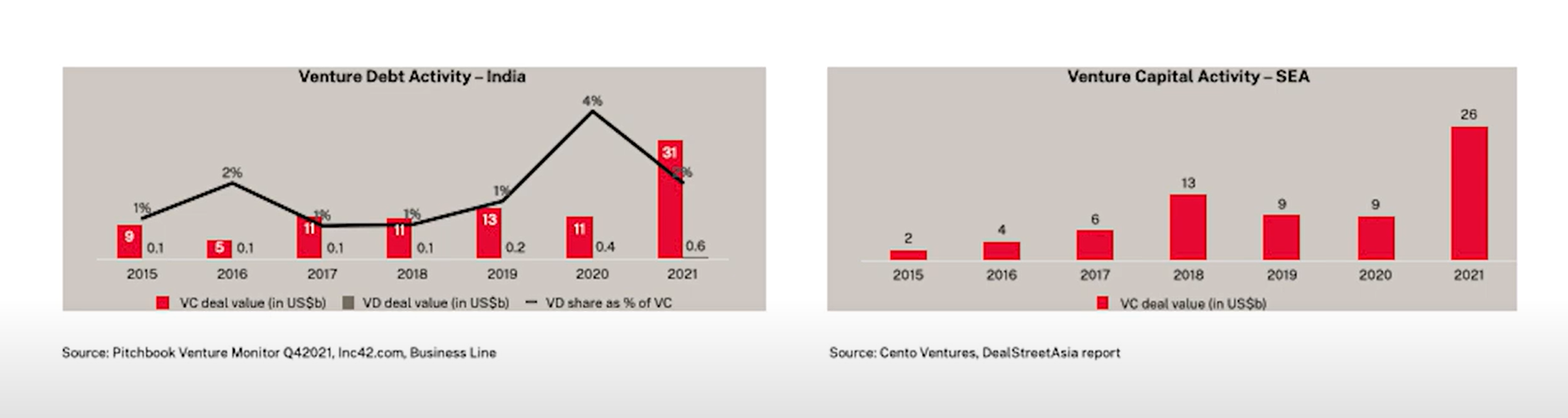

In Southeast Asia and India, venture debt remains comparatively new. In India, the third largest ecosystem in the world with over 100 unicorns, close to US$30 billion of venture capital was invested in 2021 but only US$ 600 million of venture debt was invested.

Similarly in Southeast Asia, last year close to US$25 billion of venture capital was invested, but venture debt remains insignificant.

As these regions are yet to catch up with their global counterparts, there is a huge opportunity present here for venture debt investors.

Let’s take a look at what venture debt actually is and how it benefits the startup sector.

Venture Debt: What is it?

Venture Debt is a form of loan given to early stage but high growth startups that may not have positive cash flows or significant assets to be used as collateral under traditional bank lending.

Venture debt as a financing method includes the usual components of a traditional loan such as an interest and a principal which is repaid over time. In order to protect the lenders from the additional risk of financing an early stage startup, venture debt is also accompanied with warrants. Warrants give lenders the rights to purchase equity, compensating for the higher risk of loan default.

Companies can deploy venture debt for various purposes including research and development, introduce new product lines, increase working capital needs, expand operations and more.

How it is different from Venture Capital

Unlike equity financing, venture debt does not dilute equity or give up control to new shareholders. This equity can significantly fluctuate in value with time according to how the business is growing. On the other hand, venture debt is paid back over time with interest and the cost of debt and the amount to be repaid is fixed as per pre-agreed interest rates.

Equity investments also require an updated company valuation which is not a requirement to secure venture debt.

Venture debt funds are usually to early stage startups which may not be cash flow positive or have visibility on their future cash flows. This practice is uncommon with venture capital funding.

Sectors which fit the venture debt bill

Venture debt is mostly sector agnostic but startups from the fintech and SaaS sectors tend to attract more venture debt funds when compared to other sectors.

When evaluating the start ups, venture debt lenders look at how much capital the startup has raised from high quality VC investors. This is necessary because venture debt lenders usually rely on the start up’s upcoming funding round for the loan repayment.

Also, startups backed by marquee VC investors tend to have more capability to weather challenging market conditions. Startups are also evaluated on their business model. profitability, and unit economics.

Benefits of Venture Debt

Venture debt allows founders, especially VC-backed startups to minimise their shareholder dilution while they are still in the early stages of growth. Venture debt offers additional cash runway between fundraising rounds, fulfilling the working capital requirements for startups and helping them achieve the business targets.

Venture debt funds also support companies in case of unexpected market downturns and helps them fight challenging economic conditions such as those arising out of global pandemics.

Lighthouse Canton’s venture debt strategy

Headquartered in Singapore, Lighthouse Canton is a global investment institution with wealth and asset management capabilities.

Under their dedicated strategy to cater to the needs of startups and their founders, Lighthouse Canton recently launched a regional venture debt strategy comprising a Singapore based Variable Capital Company (VCC) for investments in South East Asia, and a Category II Alternative Investment Fund (AIF) for investments in India. Lighthouse Canton is targeting to raise US$ 100mn for this strategy and has already seen participation from global institutions and family offices. The Fund shall provide debt capital to technology-enabled companies which are part of the startup ecosystem in the region.

Reach out to us today to know more about opportunities in venture debt investments and early stage, high growth startups.